Social Media

SEC approves 1st consumer RegA+ token Props for cross-app rewards

After cracking down on ICOs, the SEC just okayed the first two RegA+ tokens that offer an alternative way for anyone to gain a financial stake in a company, even unaccredited investors. Blockstack got approved for a $28 million digital token sale to raise money, while influencer live streaming app YouNow’s spin-off Props received a formal green light for a consumer utility ‘Howey’ token users can earn to get loyalty perks in multiple apps.

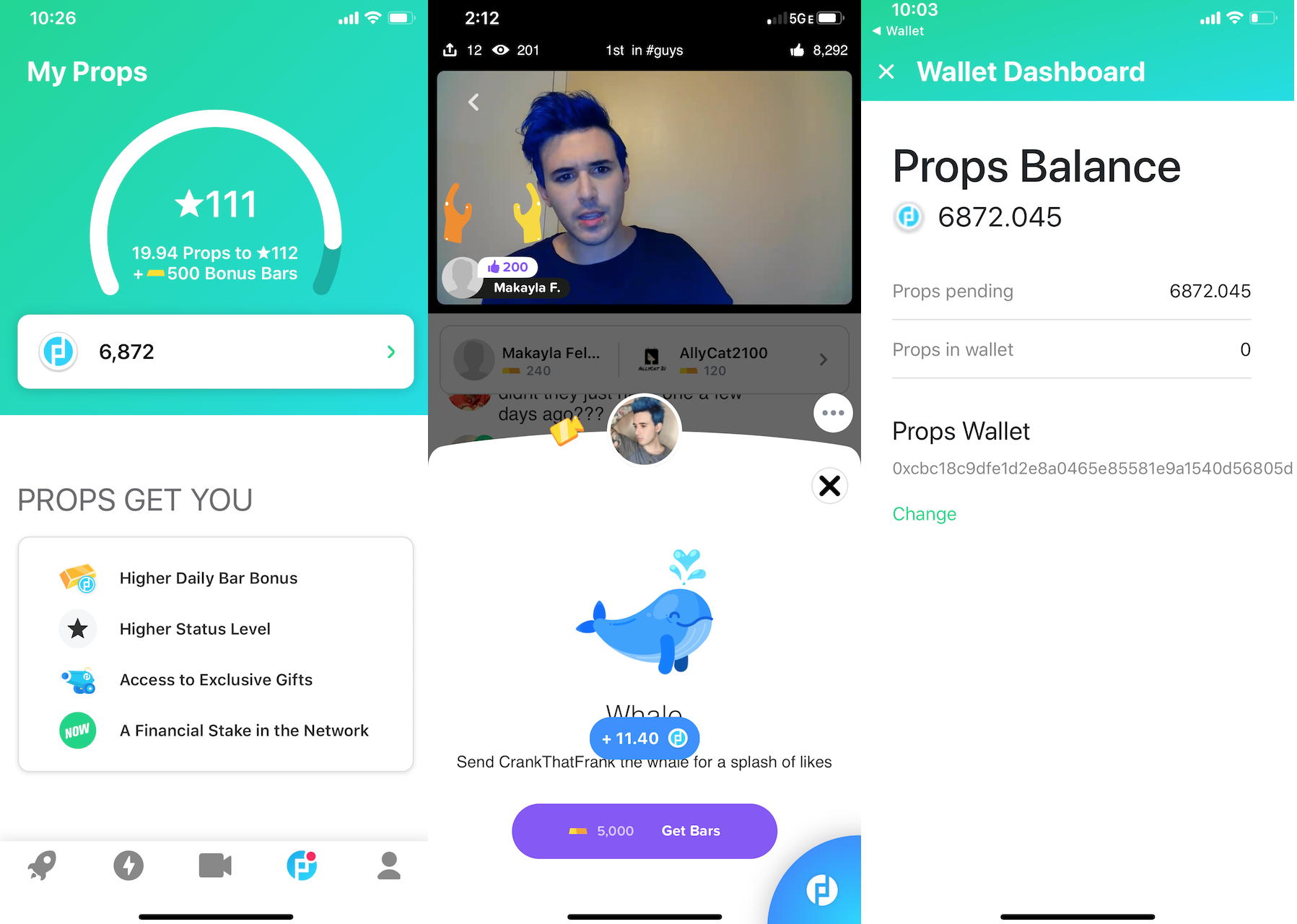

Props has already raised $21 million by pre-selling tokens to Union Square Ventures, Comcast, Venrock, Andreessen Horowitz’s Chris Dixon, and YouTuber Casey Neistat, so it isn’t raising any money with the RegA+ by selling its tokens like Blockstack. Instead, users earn or ‘mine’ Props by engaging with apps like YouNow, which will award the tokens for creating broadcasts, watching videos, and tipping creators. Having more Props entitles YouNow’s 47 million registered users bonus features, VIP status, and more purchasing power with the app’s proprietary credits called Bars which users have bought $70 million-worth of to date.

But unlike most virtual currencies that can only be used in a single app and don’t technically belong to consumers, the open-sourced Props blockchain system can be integrated into other apps via an API and people can export their Props to cryptocurrency wallets. That lets them apply their Props in other apps beyond YouNow. Four partnered apps have been lined up including xSplit, a 17 million registered user app for video game streaming.

While Props aren’t currently redeemable for fiat currency, they were valued at $0.1369 each by the SEC-approved filing. The company is working to have Props listed on Alternative Trading Systems that work similarly to cryptocurrency exchanges. That lets Props give everyday app users a financial incentive to see the network of apps that adopt them grow. Since there’s a finite supply of 1 billion Props (with 600 million mined so far), if demand for Props rises then users could sell them for more. This creates a new growth hacking method for startups by providing a way to reward early and hardcore users.

“Our offering of Props is the first consumer-facing offering of “Howey tokens” to be qualified by the SEC. It makes it the first offering of consumer-oriented utility tokens that the SEC deems compliant, outside of Bitcoin and Ether” Props CEO Adi Sideman tells me. While SEC officials have said Bitcoin and Ether aren’t securities thanks to their sufficient decentralization, they haven’t received formal approval. “We used Regulation A+ (Reg A) for this qualification, so that Props may be earned by, and provide functionality to, non accredited investors, users, apps and validators, in compliance with US regulations.”

However this could also create risk for less savvy users who might misunderstand the token system and be overly convinced they’ll get rich by watching tons of musicians or comedians streaming on YouNow. Props will need to ensure partners that integrate its tokens don’t exaggerate their potential. It’s spent two years working on SEC approval but could still face consequences if Props are misrepresented.

“Props enables us to turn creators into stakeholders in the network, meaning they become partners in the success of the network. It’s an important tool for us to better incentivize and align with the most important users of our apps” PeerStream CEO Alex Harrington writes. “Props abstracts, for us as developers, the technical and regulatory complexity associated with blockchain-based tokens, through a simple set of APIs that we can use to integrate the token into our apps’ experience.”

With Blockstack and Props having pioneered the RegA+ approach, we could see more companies filing to use this method of raising money or sharing stakes with their users.

-

Entertainment7 days ago

Entertainment7 days agoNASA discovered bacteria that wouldn’t die. Now it’s boosting sunscreen.

-

Business6 days ago

Business6 days agoTesla drops prices, Meta confirms Llama 3 release, and Apple allows emulators in the App Store

-

Business6 days ago

Business6 days agoTechCrunch Mobility: Cruise robotaxis return and Ford’s BlueCruise comes under scrutiny

-

Entertainment6 days ago

Entertainment6 days ago‘The Sympathizer’ review: Park Chan-wook’s Vietnam War spy thriller is TV magic

-

Business4 days ago

Business4 days agoTesla layoffs hit high performers, some departments slashed, sources say

-

Business5 days ago

Business5 days agoMeta to close Threads in Turkey to comply with injunction prohibiting data-sharing with Instagram

-

Entertainment4 days ago

Entertainment4 days agoChatGPT vs. Gemini: Which AI chatbot won our 5-round match?

-

Business3 days ago

Business3 days agoFormer top SpaceX exec Tom Ochinero sets up new VC firm, filings reveal