Technology

Save 25% on H&R Block’s online solutions to help you file your taxes

Surely, we won’t go as far as to say doing your own taxes is fun, but we will quietly suggest it’s not nearly as scary or panic attack-y as you think. If you have a pretty straightforward tax situation, like being a student or a W-2 employee, H&R Block’s free version may be all you need.

However, if you have a few more things going on, such as side hustles, investments, or kiddos, H&R Block’s online tax solutions are fast, easy, and accurate. You can use these tax-filing tools on your own or with the help of their deduction-savvy experts.

Keep in mind though, this year you’ll be needing to get your return done by April 18 in most states (those bittersweet days of the IRS playing it a bit loose with deadlines are now over) and e-filing started on January 24.

On the bright side, H&R Block is offering an exclusive 25% off discount until April 18. For tax season 2022, here are some scenarios which may apply to you and how to handle them.

Get the largest child tax credit in U.S. history

A couple studying their finances with children.

Credit: kate_sept2004 / Getty Images

If you’re a parent, you may have started automatically receiving monthly payments for eligible children last July. It was the first time in U.S. history, child tax credits were paid upfront —usually, you have to wait until you file your taxes. Since you’ll claim the rest on your return, and every family is unique, H&R Block Deluxe Online simplifies child care expenses and itemized deductions.

Report your crypto earnings

Young woman checking her phone in bustling city.

Credit: d3sign / Getty Images

Have an app on your phone for buying and selling cryptocurrency? Those crypto winnings are taxable. For anyone with new-school or old-school investments, H&R Block Premium Online has you covered for reporting capital gains and stock sales correctly. You’ll also have access to a tax pro for on-demand chats and video, screen sharing, and support on any device.

Deduct industry-specific expenses

Man helps woman in his shop.

Credit: Halfpoint Images / Getty Images

It can be tricky determining what you can and can’t deduct when you’re self-employed or own a small business. H&R Block Self-Employed Online offers personalized guidance to maximize your refund guaranteed. They’ll help you accurately report profits and losses and in the off chance you do get audited or there’s an error, they’ll stick around for free until it’s sorted out.

-

Entertainment6 days ago

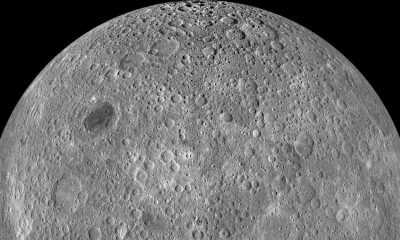

Entertainment6 days agoWhat’s on the far side of the moon? Not darkness.

-

Business7 days ago

Business7 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business6 days ago

Business6 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business5 days ago

Business5 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business7 days ago

Business7 days agoPhoto-sharing community EyeEm will license users’ photos to train AI if they don’t delete them

-

Entertainment6 days ago

Entertainment6 days agoHow to watch ‘The Idea of You’: Release date, streaming deals

-

Entertainment5 days ago

Entertainment5 days agoMark Zuckerberg has found a new sense of style. Why?

-

Business5 days ago

Business5 days agoHumanoid robots are learning to fall well