Technology

Dropbox CEO Drew Houston on running a public company

Dropbox CEO Drew Houston said there’s pros and cons to running a public company.Drew Angerer / Getty

Dropbox CEO Drew Houston said there’s pros and cons to running a public company.Drew Angerer / Getty

- Two weeks before going public in March, Dropbox CEO Drew Houston overheard a conversation that really freaked him out.

- Houston overheard an interview where someone suggested that going public is “finding a way to live in hell without dying.”

- So far in his experience, Houston said, there have been pros and cons.

- Houston reflected on that conversation and his experience running a public company Wednesday, on stage at TechCrunch Disrupt.

SAN FRANCISCO — Two weeks before Dropbox went public, founder and CEO Drew Houston got spooked.

While attending a conference in March, Houston overheard an interview with the head of Nasdaq. The first question was whether it’s true that going public is “finding a way to live in hell without dying.”

Speaking at TechCrunch Disrupt on Wednesday, Houston said that comment freaked him out. Since its founding in 2007, Dropbox had been a private company, accountable only to its investors. But public companies are required to file quarterly reports on their financials every quarter, for all the world to see.

At the time of the comment, Houston was just one week out from the investor roadshow that would ultimately see Dropbox priced at $7.4 billion. When Dropbox made its big debut on the public markets on March 23, investors dug in and the stock price price surged, giving the company a valuation of nearly $12 billion.

So far, Houston said, running a public company has been a mixed experience.

“There’s pros and cons on either side. The advantages of being private is that you have a different investor base, a different level of scrutiny, and so on,” Houston said.

“We’ve been public for a couple of quarters. I’ve been surprised that there weren’t more surprises,” he continued. “We’ve laid the tracks for being a public company for the last few years; The IPO was graduation day but all the work was three years prior.”

Houston said that being public requires a greater level of rigor and financial predictability, and warned the audience against “innovating on the accounting or legal front” if they want to avoid scrutiny from the Securities and Exchange Commission.

But, he said, he also appreciates that he can be more transparent with his staff now that the company is reporting its financial information quarterly. Until going public, Dropbox management wasn’t able to openly discuss its valuation with employees, many of whom owned equity in the company.

“People really freak out about the uncertainty there,” Houston said.

-

Entertainment7 days ago

Entertainment7 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Entertainment6 days ago

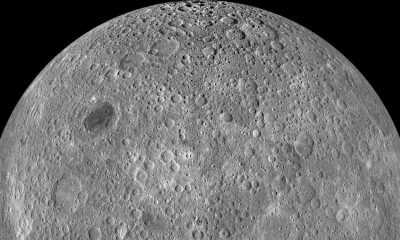

Entertainment6 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business7 days ago

Business7 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

Business5 days ago

Business5 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business5 days ago

Business5 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business6 days ago

Business6 days agoPhoto-sharing community EyeEm will license users’ photos to train AI if they don’t delete them

-

Entertainment7 days ago

Entertainment7 days ago‘Challengers’ review: You’re not ready for Zendaya’s horny love-triangle drama