Technology

Barclays teams with MarketInvoice as banks look to partner

The signage of a branch of

Barclays bank in central London.

Oli

Scarff/Getty Images

-

Barclays has taken a stake in and partnered with UK SME

lender MarketInvoice. -

It is one of a number of recent partnerships between

established banks and fintech startups. -

Banks used to either buy or build new products and

services but are increasingly favouring partnerships, realising

they can’t be experts at everything.

LONDON — Not so long ago, most banks took one of two approaches

when launching new products and services: build or buy.

Increasingly, however, there’s a third way: partner.

Barclays announced on Thursday that it has taken a stake in

online small business lender MarketInvoice and is partnering with

the startup to offer MarketInvoice’s lending capabilities to its

small business clients.

London-headquartered MarketInvoice, founded in 2011, offers

invoice factoring and lines of credit to small and medium-sized

businesses. It has lent over £2.7 billion to date.

Barclays said in a release that the tie-up is part of its “plans

to invest in new business models for growth, and MarketInvoice’s

ambition to broaden its reach across the UK.” Crucially, Barclays

has only taken what it calls a “significant minority” stake,

rather than a controlling ownership holding. It means

MarketInvoice should continue to operate at somewhat of an arm’s

length.

Barclays isn’t the first to turn to an innovative startup to help

them power growth through partnerships. Spanish bank Santander

signed a deal with online lender Kabbage in 2016, and JPMorgan

has had a small business lending tie-up with OnDeck Capital since

2015, for example.

Banks are embracing the old maxim: if you can’t beat them, join

them. Rather than spend millions building out new business lines

to compete with these upstarts, banks are deciding instead that

it’s easier to simply use the resources that these companies have

developed.

In the past, this has generally led to acquisitions of the most

promising challengers. But there’s a growing sense that this

approach can often stifle the very innovation that made a startup

so compelling. In some cases, it can also turn out to be a costly

mistake. Spanish bank BBVA last year had to take a $60 million

write-down on its $117 million 2014 acquisition of US digital

bank Simple, for example.

Partnership offers a “best of both worlds” approach — access to

the innovative products and services without taking on as much of

the risk (there is of course still a reputational risk associated

with a partnership). These deals also benefit the startups by

potentially kicking their growth up a gear.

More broadly, this trend speaks to the post-financial crisis mood

within banking. Lenders that once sort to be financial goliaths

now accept that they can’t be all things to all people. HSBC is

focusing on international trade and UBS is going back to its

focus on wealth management, for example.

By partnering with startups that can fill the gaps, banks can

keep their clients happy by referring them on and potentially

earning a small commission. Better than simply saying, sorry,

can’t help.

-

Entertainment7 days ago

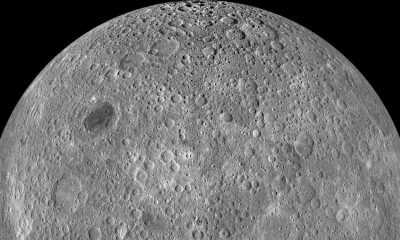

Entertainment7 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business6 days ago

Business6 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Entertainment7 days ago

Entertainment7 days agoHow to watch ‘The Idea of You’: Release date, streaming deals

-

Entertainment6 days ago

Entertainment6 days agoMark Zuckerberg has found a new sense of style. Why?

-

Business5 days ago

Business5 days agoHumanoid robots are learning to fall well

-

Entertainment5 days ago

Entertainment5 days ago2024 summer TV preview: 33 TV shows to watch this summer

-

Business4 days ago

Business4 days agoGoogle Gemini: Everything you need to know about the new generative AI platform