Startups

WeWork rebranding won’t work

The company formerly known as WeWork has rebranded as the We Company — although a better name for its network of on-demand office spaces for the newly incorporated and nominally employed, co-living spaces for the same easyJet-set and educational and coding services could be “House of Cards.”

News of the rebranding (first reported via Fast Company) comes on the heels of reports that the company would no longer be receiving a planned $16 billion golden parachute to escape a soon-to-be-sinking real estate market investment from longtime backer Masayoshi Son’s SoftBank and his SoftBank Vision Fund.

WeWork, which lost $1.2 billion over the first three quarters of 2018 according to an FT report, is rebranding to shift attention from its real estate play to a broader blend of living and educational services that now comprise the three pillars of its business (to be clear, the largest pillar is its real estate properties).

The knock against the company has always been that it was a real estate investment masquerading as a tech company (a case which FT made magisterially last year).

In the blog post, WeWork chief executive Adam Neumann laid out the company’s new strategy, which divides the company into three different business lines: WeWork (real estate), WeLive (its co-living spaces) and WeGrow (for education).

For the We Company to succeed, a few things need to happen. Revenue needs to rebalance to the WeLive and WeGrow businesses quickly and it needs to grow its services even more aggressively. And the result of each needs to be actual profitability.

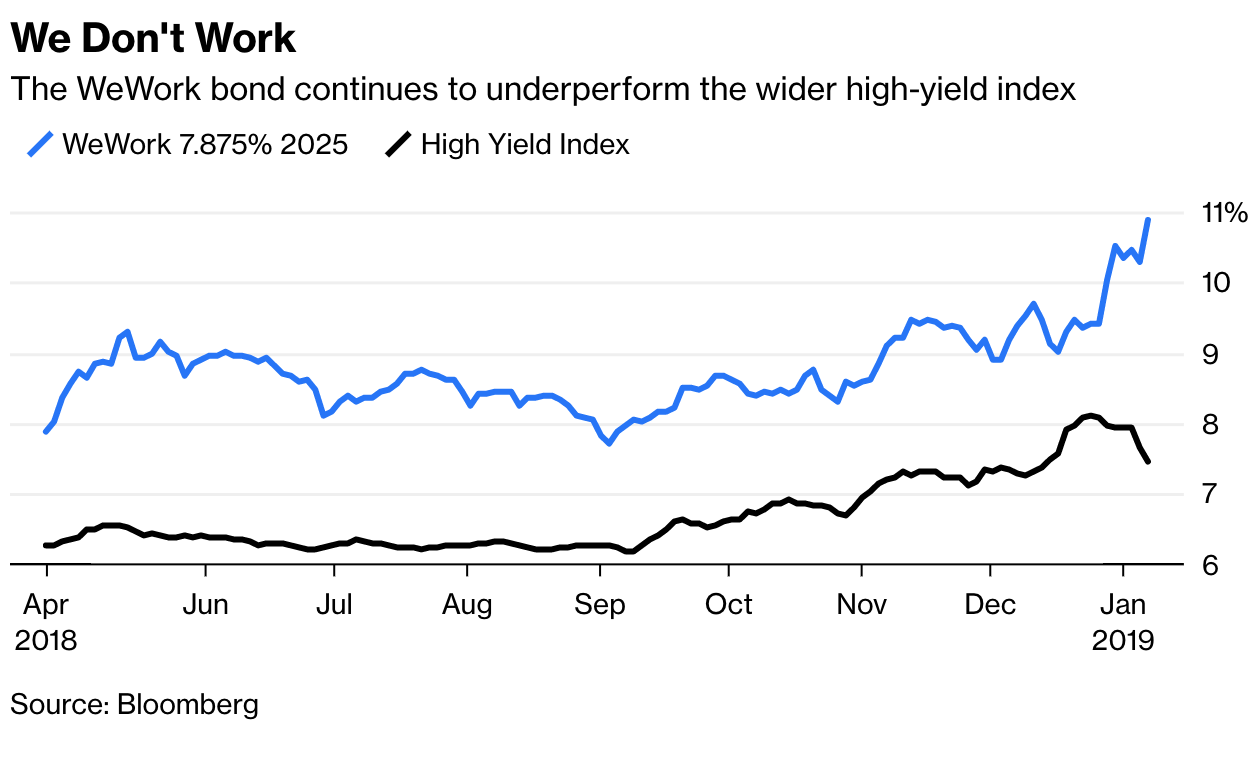

There aren’t a lot of really hard metrics to gauge the company’s current performance. But the good people at Bloomberg did uncover actual financial data on the company’s debt, which is underperforming compared to industry benchmarks.

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.

-

Entertainment7 days ago

Entertainment7 days agoHands-on with the Claude AI app: It’s pleasant to use, but janky

-

Entertainment5 days ago

Entertainment5 days agoApple Watch Series 9 vs. SE: A smartwatch skeptic tested both for 13 days

-

Business7 days ago

Business7 days agoHaun Ventures is riding the bitcoin high

-

Entertainment6 days ago

Entertainment6 days ago5 essential gadgets for turning your home into a self-care sanctuary

-

Business4 days ago

Business4 days agoGoogle lays off workers, Tesla cans its Supercharger team and UnitedHealthcare reveals security lapses

-

Entertainment5 days ago

Entertainment5 days agoThe greatest films on Prime Video right now

-

Business5 days ago

Business5 days agoGoogle dubs Epic’s demands from its antitrust win ‘unnecessary’ and ‘far beyond the scope’ of the verdict

-

Business6 days ago

Business6 days agoApple: pay attention to emerging markets, not falling China sales