Startups

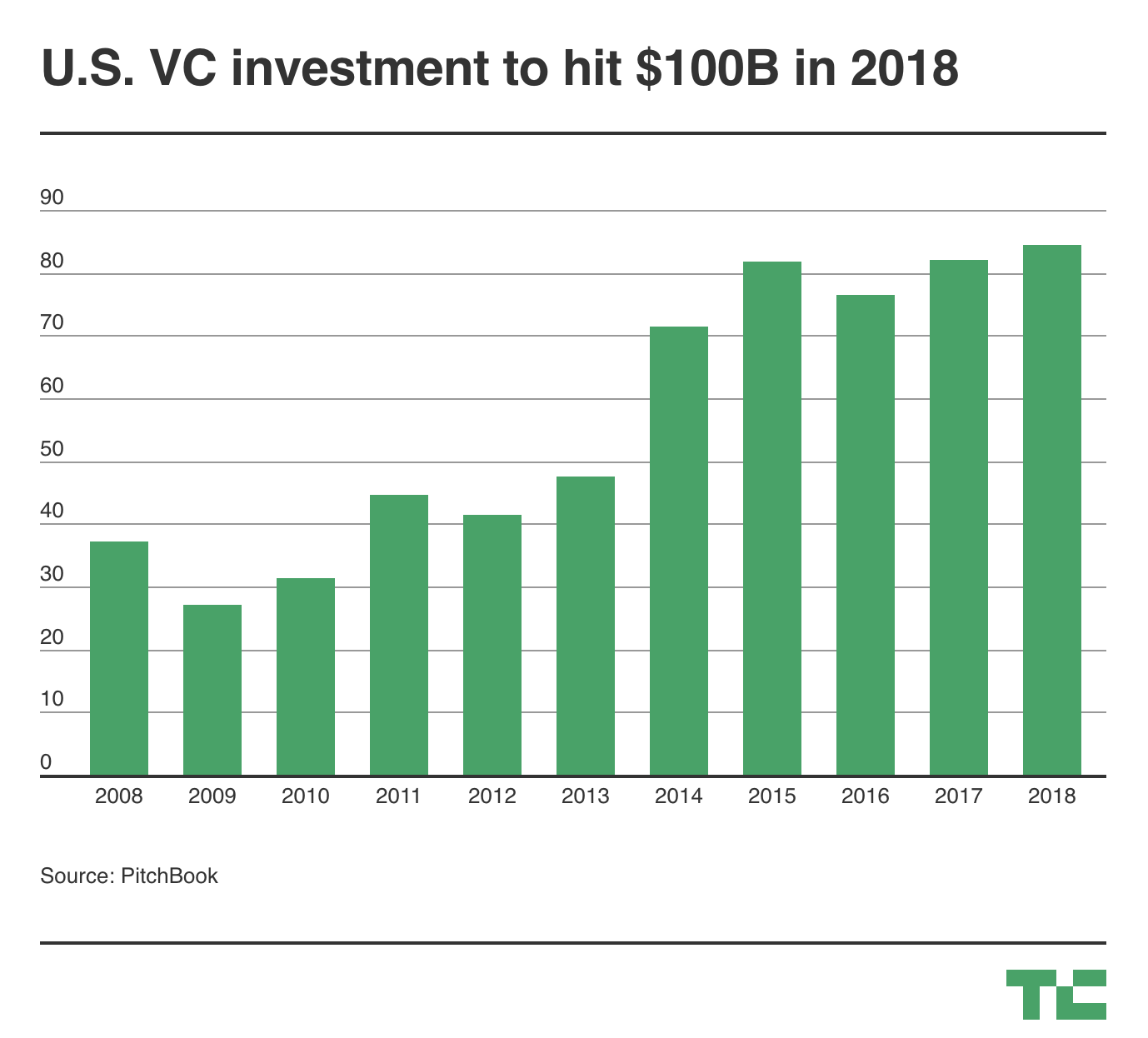

Venture capital investment in US companies to hit $100B in 2018

So many new unicorns valued at $1 billion-plus, countless $100 million venture financings, an explosion of giant funds — it’s no surprise 2018 is shaping up to be a banner year for venture capital investment in U.S.-based companies.

There are more than 2.5 months remaining in 2018 and already U.S. companies have raised $84.1 billion — more than all of 2017 — across 6,583 VC deals as of Sept. 30, 2018, according to data from PitchBook’s 3Q Venture Monitor.

Last year, companies raised $82 billion across more than 9,000 deals in what was similarly an impressive year for the industry. Many questioned whether the trend would — or could — continue this year, and oh, boy has it. VC investment has sprinted past decade-highs and shows no signs of slowing down.

Why the uptick? Fewer companies are raising money, but round sizes are swelling. Unicorns, for example, were responsible for about 25 percent of the capital dispersed in 2018. Those companies, which include Slack, Stripe and Lyft, have raised $19.2 billion so far this year — a record amount — up from $17.4 billion in 2017. There were 39 deals for unicorn companies valuing $7.96 billion in the third quarter of 2018 alone.

Some other interesting takeaways from PitchBook’s report on the U.S. venture ecosystem:

- Nearly $28 billion was invested into early-stage startups in 2018, with median deal size increasing 25 percent to $7 million last quarter.

- Ten funds have raised more than $500 million this year and another five, including Lightspeed Venture Partners and Index Ventures, have closed on more than $1 billion.

- Companies based on the West Coast were responsible for 54.7 percent of deal value in 3Q but other regions are catching up: New England (12 percent), the Mid-Atlantic (20 percent) and The Great Lakes (5 percent).

- Investment in U.S. pharma and biotech has reached a new high of $14 billion already in 2018.

- Corporate venture capital activity is heating up. This year, CVCs invested $39.3 billion in U.S. startups, more than double the $15.2 billion invested in 2013.

- VC-backed companies are exiting via buyouts more than ever.

-

Entertainment7 days ago

Entertainment7 days agoThis nova is on the verge of exploding. You could see it any day now.

-

Business7 days ago

Business7 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business6 days ago

Business6 days agoThis camera trades pictures for AI poetry

-

Business5 days ago

Business5 days agoTikTok Shop expands its secondhand luxury fashion offering to the UK

-

Business6 days ago

Business6 days agoBoston Dynamics unveils a new robot, controversy over MKBHD, and layoffs at Tesla

-

Business5 days ago

Business5 days agoMood.camera is an iOS app that feels like using a retro analog camera

-

Entertainment7 days ago

Entertainment7 days agoEarth will look wildly different in millions of years. Take a look.

-

Business4 days ago

Business4 days agoUnitedHealth says Change hackers stole health data on ‘substantial proportion of people in America’