Business

N26 launches its challenger bank in the U.S.

European fintech startup N26 is now accepting customers in the U.S. The company is launching a bank account with a debit card that should provide a better experience compared to traditional retail banks.

If you’re familiar with N26, the product that is going live today won’t surprise you much. Customers in the U.S. can download a mobile app and create a bank account from their phone in just a few minutes. It’s a true bank account with ACH payments, routing and account numbers.

A few days later, you receive a debit card that you can control from the mobile app. Every time you make a transaction, you instantly receive a push notification telling you how much money you just paid. You can set up your PIN code, customize limits, turn on and off online payments, ATM withdrawals or payments abroad.

And that’s about all there’s to know. But what about fees? Basic N26 accounts are free. There’s no monthly fee and no minimum balance. There’s no fee on transactions in a foreign currency and you get two free ATM withdrawals per month.

N26 is going to progressively roll out signups over the summer as a sort of beta program. If you’ve signed up to the waitlist, you’ll get an invitation over the coming hours, days and weeks. There are currently 100,000 people on the waitlist. N26 will then open signups to everyone later this summer.

When N26 rolls out its final product in a couple of months, the company says that it plans to automatically find and reimburse fees the ATM operators are charging. N26 cards in the U.S. work on the Visa network instead of Mastercard.

Just like Chime, N26 will also try to let you get paid up to 2 days early if you get paid via direct deposit. Instead of waiting a couple of days to clear those transactions, N26 will go ahead and top up your account.

White label

Behind the scene, there are a few differences between N26 in Europe and N26 in the U.S. While N26 has a full-fledged banking license in Europe, the company has partnered with Axos Bank who is acting as a white-label partner in the U.S.

Axos Bank essentially manages your money for you, and N26 acts as the interface between customers and their bank accounts. As a result, you get an FDIC-insured account.

N26 first partnered with a third-party company in Europe as well. But it was a costly deal that wasn’t meant to stick around. The startup got a banking license in Germany that was good for Europe at large. In the U.S., it’s a different story as the market is not as unified as in Europe — it’s complicated to get a license to operate in all 50 states.

“We looked at 30 players, we did some due diligence and we’re happy to partner with Axos Bank. The deals that you get in the U.S. for white-label banks are much more favorable than in Europe,” N26 co-founder and CEO Valentin Stalf told me. “It’s a setup for the longer term. It’s good for a couple million customers,” Stalf added later in the conversation.

Just a start

N26 is already planning more features for the U.S. The company plans to roll out two premium plans — N26 Metal and then N26 Black.

And it sounds like there will be some changes when it comes to perks for premium users. “We took that to a separate level,” Stalf said.

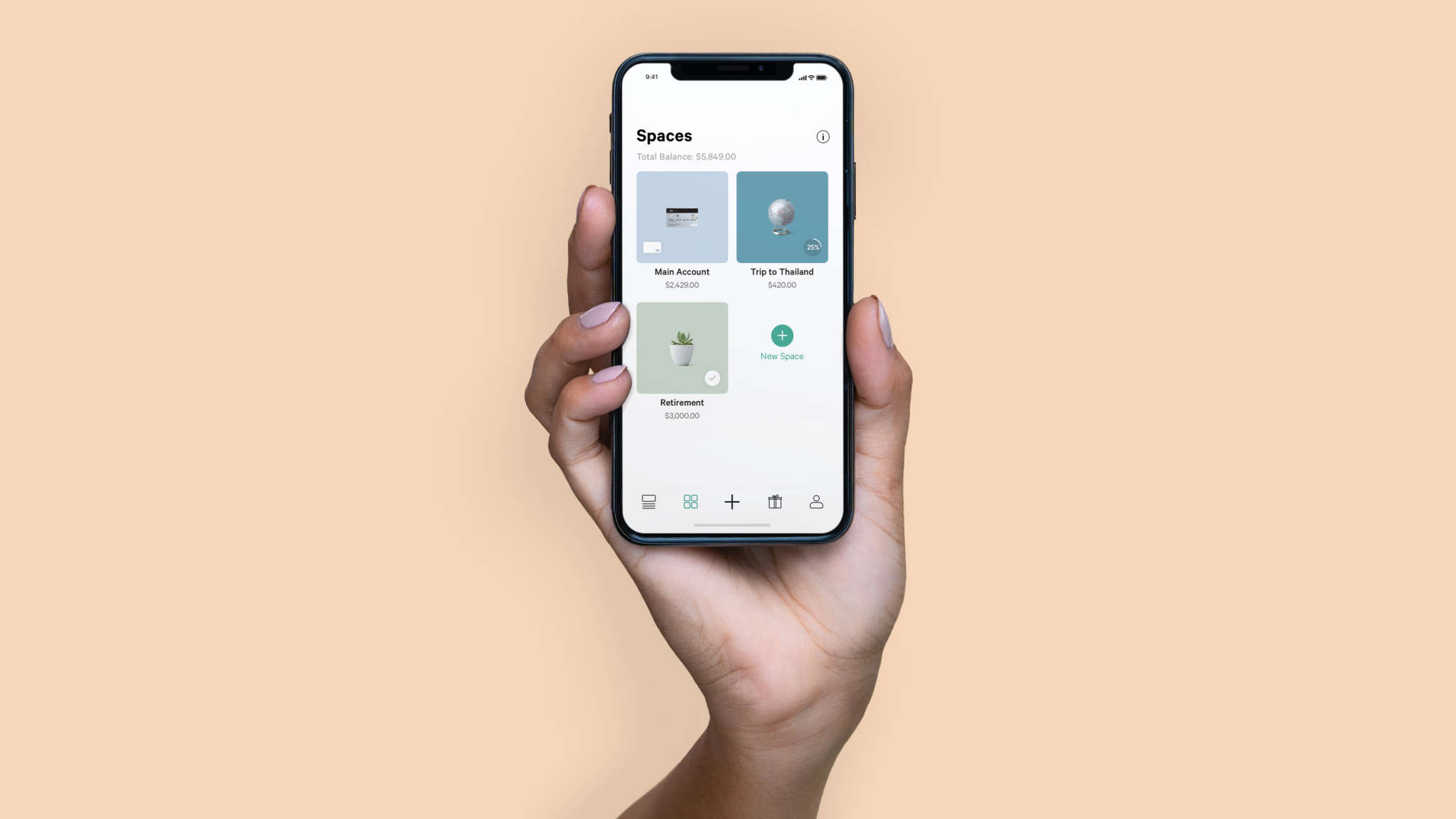

Another feature, shared Spaces are finally arriving in the coming months. Spaces are sub-accounts designed to put money aside. You can swipe money from one Space to another or you can set up automated rules.

Eventually, you’ll be able to share a Space with other people so that you can save money and spend money together. It’ll work “like a WhatsApp group,” Stalf said.

N26 currently has 3.5 million customers in Europe and has raised over $500 million in total so far. There are now a thousand people working for N26 in Berlin, 60 employees in New York, 80 people in Barcelona and a small team of 5 to 10 people starting soon in Vienna.

“It went from being a small company to being an international company,” Stalf said.

-

Business6 days ago

Business6 days agoLangdock raises $3M with General Catalyst to help businesses avoid vendor lock-in with LLMs

-

Entertainment6 days ago

Entertainment6 days agoWhat Robert Durst did: Everything to know ahead of ‘The Jinx: Part 2’

-

Entertainment5 days ago

Entertainment5 days agoThis nova is on the verge of exploding. You could see it any day now.

-

Business5 days ago

Business5 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business5 days ago

Business5 days agoThis camera trades pictures for AI poetry

-

Business6 days ago

Business6 days agoCesiumAstro claims former exec spilled trade secrets to upstart competitor AnySignal

-

Business4 days ago

Business4 days agoTikTok Shop expands its secondhand luxury fashion offering to the UK

-

Business7 days ago

Business7 days agoInternet users are getting younger; now the UK is weighing up if AI can help protect them