Business

Investors still love software more than life

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

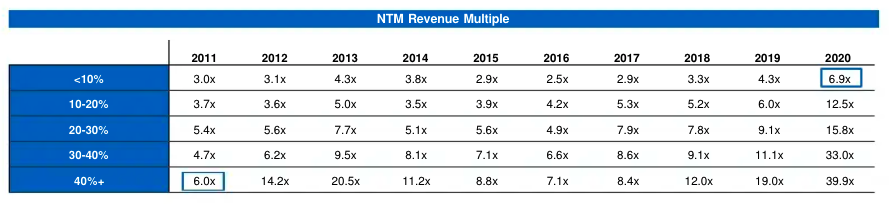

Despite some recent market volatility, the valuations that software companies have generally been able to command in recent quarters have been impressive. On Friday, we took a look into why that was the case, and where the valuations could be a bit more bubbly than others. Per a report written by few Battery Ventures investors, it stands to reason that the middle of the SaaS market could be where valuation inflation is at its peak.

Something to keep in mind if your startup’s growth rate is ticking lower. But today, instead of being an enormous bummer and making you worry, I have come with some historically notable data to show you how good modern software startups and their larger brethren have it today.

In case you are not 100% infatuated with tables, let me save you some time. In the upper right we can see that SaaS companies today that are growing at less than 10% yearly are trading for an average of 6.9x their next 12 months’ revenue.

Back in 2011, SaaS companies that were growing at 40% or more were trading at 6.0x their next 12 month’s revenue. Climate change, but for software valuations.

One more note from my chat with Battery. Its investor Brandon Gleklen riffed with The Exchange on the definition of ARR and its nuances in the modern market. As more SaaS companies swap traditional software-as-a-service pricing for its consumption-based equivalent, he declined to quibble on definitions of ARR, instead arguing that all that matters in software revenues is whether they are being retained and growing over the long term. This brings us to our next topic.

Consumption v. SaaS pricing

I’ve taken a number of earnings calls in the last few weeks with public software companies. One theme that’s come up time and again has been consumption pricing versus more traditional SaaS pricing. There is some data showing that consumption-priced software companies are trading at higher multiples than traditionally priced software companies, thanks to better-than-average retention numbers.

But there is more to the story than just that. Chatting with Fastly CEO Joshua Bixby after his company’s earnings report, we picked up an interesting and important market distinction between where consumption may be more attractive and where it may not be. Per Bixby, Fastly is seeing larger customers prefer consumption-based pricing because they can afford variability and prefer to have their bills tied more closely to revenue. Smaller customers, however, Bixby said, prefer SaaS billing because it has rock-solid predictability.

I brought the argument to Open View Partners Kyle Poyar, a venture denizen who has been writing on this topic for TechCrunch in recent weeks. He noted that in some cases the opposite can be true, that variably priced offerings can appeal to smaller companies because their developers can often test the product without making a large commitment.

So, perhaps we’re seeing the software market favoring SaaS pricing among smaller customers when they are certain of their need, and choosing consumption pricing when they want to experiment first. And larger companies, when their spend is tied to equivalent revenue changes, bias toward consumption pricing as well.

Evolution in SaaS pricing will be slow, and never complete. But folks really are thinking about it. Appian CEO Matt Calkins has a general pricing thesis that price should “hover” under value delivered. Asked about the consumption-versus-SaaS topic, he was a bit coy, but did note that he was not “entirely happy” with how pricing is executed today. He wants pricing that is a “better proxy for customer value,” though he declined to share much more.

If you aren’t thinking about this conversation and you run a startup, what’s up with that? More to come on this topic, including notes from an interview with the CEO of BigCommerce, who is betting on SaaS over the more consumption-driven Shopify.

Next Insurance, and its changing market

Next Insurance bought another company this week. This time it was AP Intego, which will bring integration into various payroll providers for the digital-first SMB insurance provider. Next Insurance should be familiar because TechCrunch has written about its growth a few times. The company doubled its premium run rate to $200 million in 2020, for example.

The AP Intego deal brings $185.1 million of active premium to Next Insurance, which means that the neo-insurance provider has grown sharply thus far in 2021, even without counting its organic expansion. But while the Next Insurance deal and the impending Hippo SPAC are neat notes from a hot private sector, insurtech has shed some of its public-market heat.

Stocks of public neo-insurance companies like Root, Lemonade and MetroMile have lost quite a lot of value in recent weeks. So, the exit landscape for companies like Next and Hippo — yet-private insurtech startups with lots of capital backing their rapid premium growth — is changing for the worse.

Hippo decided it will debut via a SPAC. But I doubt that Next Insurance will pursue a rapid ramp to the public markets until things smooth out. Not that it needs to go public quickly; it raised a quarter billion back in September of last year.

Various and Sundry

What else? Sisense, a $100 million ARR club member, hired a new CFO. So we expect them to go public inside the next four or five quarters.

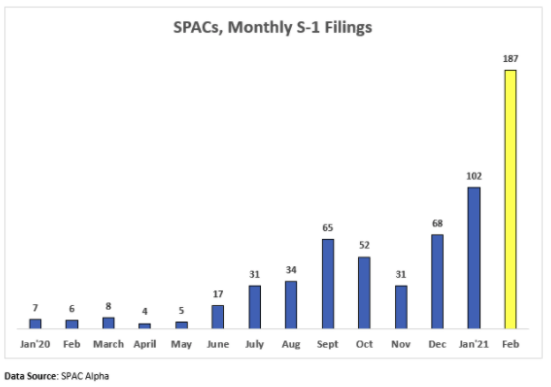

And the following chart, which is via Deena Shakir of Lux Capital, via Nasdaq, via SPAC Alpha:

-

Entertainment6 days ago

Entertainment6 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Entertainment5 days ago

Entertainment5 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

Business6 days ago

Business6 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business5 days ago

Business5 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business4 days ago

Business4 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business7 days ago

Business7 days agoZomato’s quick commerce unit Blinkit eclipses core food business in value, says Goldman Sachs

-

Entertainment7 days ago

Entertainment7 days agoMonsta X’s I.M on making music, gaming, and being called ‘zaddy’