Business

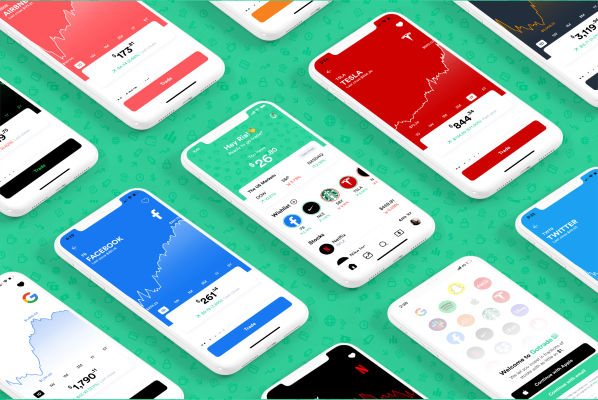

Gotrade gets $7M led by LocalGlobe to let investors around the world buy fractional shares of U.S. stocks

Stock in many American companies, like Amazon, Alphabet or Tesla, can host hundreds or thousands of dollars per share. Fractional trading, or buying part of a single share through a brokerage, makes them more accessible—at least to people within the United States. Investors in other countries, however, often have to pay high fees through interactive brokers. Gotrade makes fractional trading of U.S. stocks available to people in 150 countries, and charges a minimum of just one dollar.

The startup announced it has raised $7 million in seed funding led by LocalGlobe, with participation from Social Leverage, Y Combinator, Picus Capital and Raptor Group. The round also included angel investors like Matt Robinson, co-founder of GoCardless; Carlos Gonzalez-Cadenas, former chief product officer of Skyscanner; Frank Strauss, former head of Deutsche Bank’s global digital business; and Joel Yarbrough, Asia-Pacific head at Rapyd.

GoTrade was founded in 2019 by David Grant, Norman Wanto and Rohit Mulani. Its app launched three months ago and is currently invite-only. Gotrade claims sign-ups have grown 20% week-on-week, and it now has more than 100,000 users spread across the world. About 65% of Gotrade’s users have traded stocks before, while the rest are first-time investors.

Mulani, the company’s chief executive officer, told TechCrunch that the idea for Gotrade was planted when he became interested in American stocks, but discovered many barriers to trading.

“When I was 18, I actually looked to get access in Singapore, and banks were charging $30 per trade. Effectively, the market taught me that I could not get into the market. Fast forward ten years, I decided to look into it again, and the banks were still charging $25 a trade,” he said. “On top of that, their user interfaces were something I didn’t want to look at. So we decided to build a brokerage platform where anyone can get access.”

“Fractional trading actually came a bit later,” he added. “That was the real MVP for us because fractional really makes investing accessible to anyone globally since all you need is one dollar.”

Robinhood, SoFi and Stash all feature fractional trading, but Mulani said those apps are primarily used by U.S. residents. On the other hand, Gotrade is not available to U.S. residents because of financial regulations, so its main competitors are interactive brokers, Saxo Bank and eToro.

Gotrade does not charge commission, custody, inactivity or dividend fees. Instead, it monetizes by collecting a small fee on the currency exchange from deposits, and interest generated from uninvested cash in brokerage accounts. The app is free to use, but plans to add a premium paid subscription program and virtual debit card that users can link to their accounts.

Many of Gotrade’s users are people who have invested in their local stock markets, but weren’t able to trade U.S. stocks before. They vary widely in age, but 25- to 34-year-olds are the app’s biggest segment, and the average account size is about $500.

Gotrade acts as an introducing broker to Alpaca Securities LLC, a U.S. stock brokerage that is regulated by the Financial Industry Regulatory Authority (FINRA) and serves as an intermediary. Alpaca Securities splits its stock inventory into fractions, and Gotrade users can decide how many fractions they want to buy. The app also allows them to set a budget, and automatically calculates the amount of fractional shares they can afford through notional value trading.

User accounts are protected up to $500,000 by the Securities Investor Protection Corporation (SIPC), and money goes through counterparties regulated in Singapore, like Rapyd, and the United States, including Alpaca and First Republic Bank. To protect users, Gotrade works only with fully-funded cash accounts without any margin facility. Mulani explained that a margin account effectively means people are borrowing money to invest, while a fully-funded account means that a user can only invest the money they have already deposited in their account. FINRA and Securities Exchange Commission regulations also mean accounts under $25,000 can only day trade, or buy and sell a security on the same day, up to three times every five trading days.

Like many investment apps aimed at first-time or relatively new traders, Gotrade includes educational content, like pop-ups with definitions for investment terms, and news articles about publicly-traded companies. Its new funding will be used for hiring and product development, with a strong focus on adding more in-app content.

In a statement, LocalGlobe partner Remus Brett said, “Over the past 100 years, U.S. stocks have delivered average annual returns of 10%. With compounding, an investment of $1,000 back then would be worth $13 million today. These returns have fueled wealth creation in the U.S. and other developed markets but most of the world has missed out. We believe Gotrade has the potential to help the world’s 99% gain access the same benefits that the 1% have. We are incredibly excited to be joining Rohit, David and Norman on this journey.”

-

Entertainment7 days ago

Entertainment7 days agoApple Watch Series 9 vs. SE: A smartwatch skeptic tested both for 13 days

-

Business6 days ago

Business6 days agoGoogle lays off workers, Tesla cans its Supercharger team and UnitedHealthcare reveals security lapses

-

Entertainment6 days ago

Entertainment6 days agoThe greatest films on Prime Video right now

-

Entertainment3 days ago

Entertainment3 days agoiPad Pro 2024 now has OLED: 5 reasons this is a big deal

-

Entertainment6 days ago

Entertainment6 days agoLoneliness in kids: Screen time may play a role

-

Business5 days ago

Business5 days agoThe Rabbit r1 shipped half-baked, but that’s kind of the point

-

Business6 days ago

Business6 days agoICONIQ Growth raises $5.75B seventh flagship fund

-

Entertainment4 days ago

Entertainment4 days agoWhy should we care what celebrities like Taylor Swift and Billie Eilish say about Palestine?