Startups

Failed meal-kit service Munchery owes $6M to gift card holders, vendors

Several weeks after a sudden shutdown left customers and vendors in the lurch, meal-kit service Munchery has filed for bankruptcy. In the Chapter 11 filing, Munchery chief executive officer James Beriker cites increased competition, over-funding, aggressive expansion efforts and Blue Apron’s failed IPO as reasons for its demise.

Munchery owes $3 million in unfulfilled customer gift cards and another $3 million to its vendors, suppliers and various counterparties, the filing reveals. The company’s remaining debt includes $5.3 million in senior secured debt and convertible debt of approximately $23 million. Munchery says its scrounged up $5 million from a buyer of its equipment, machinery and San Francisco headquarters.

The business had raised more than $100 million in venture capital funding, reaching a valuation of $300 million in 2015 before ceasing operations on January 22 and laying off 257 employees in the process. Munchery was backed by Menlo Ventures, Sherpa Capital, e.Ventures, Cota Capital and others.

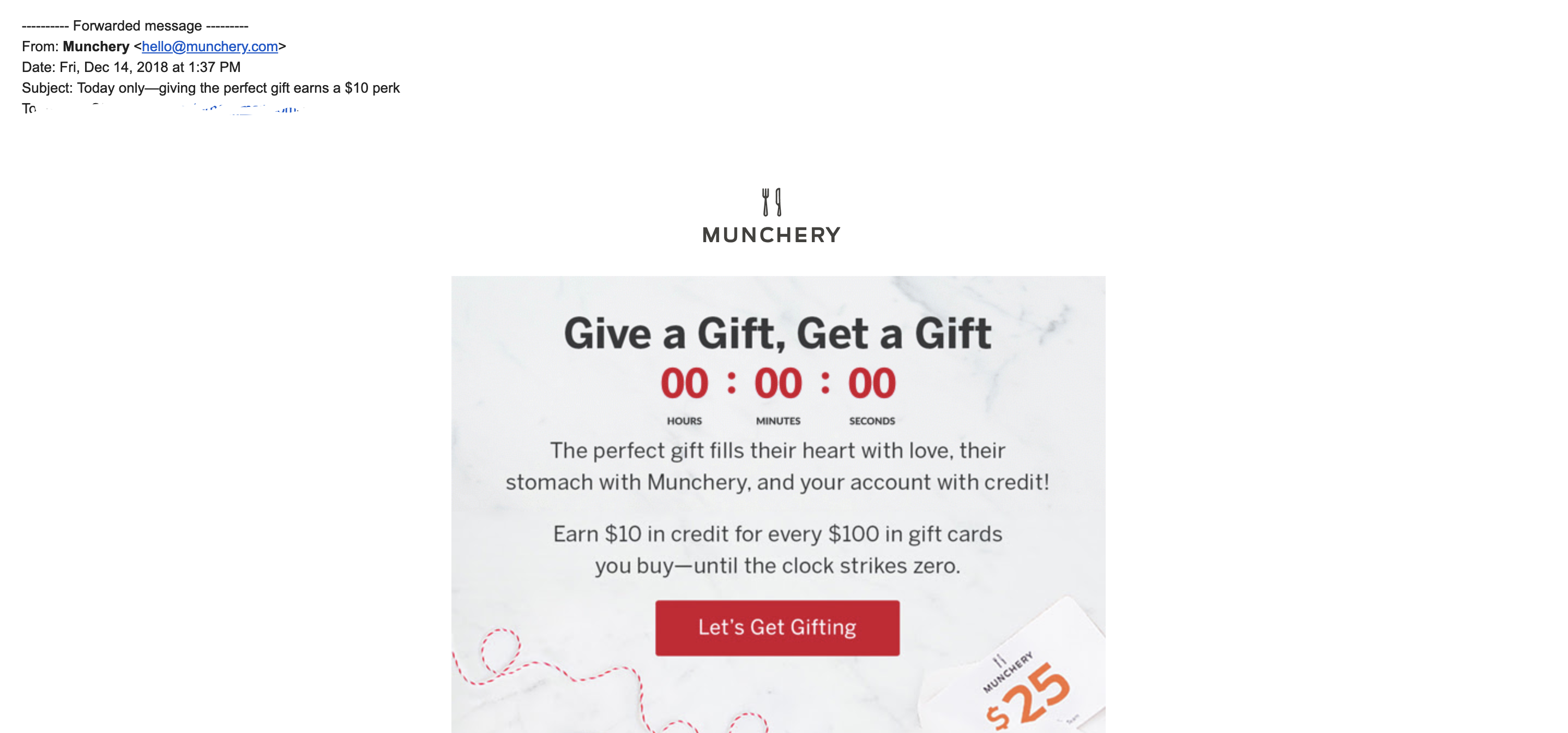

The company, which failed to notify its vendors it was going out of business, has been scrutinized for failing to pay those vendors in the wake of its shutdown. To make matters worse, emails viewed by TechCrunch show Munchery continued aggressively marketing its gift cards in emails sent to customers in December, weeks before a final email to those very same customers announced it was ceasing operations, effectively immediately.

An email advertising Munchery gift cards sent to a customer weeks before the startup went out of business.

The latest court filings shed light on Beriker’s decision-making process in those final months, touching on Munchery’s frequent pivots, the company’s 2017 layoffs, its plans to scale sales of Munchery products in Amazon Go stores and failed attempts at a sale. Beriker is the sole remaining Munchery board member. He has not responded to several requests for comment from TechCrunch.

In the third quarter of 2018, Munchery, at the recommendation of its board, hired an investment bank to find a buyer for the startup, to no avail. Beriker suggests the lack of a buyer, coupled with industry trends like larger-than-necessary venture capital rounds and inflated valuations, were cause for the startup’s failure to deliver.

“The company expanded too aggressively in its early years,” the filing states. “The access to significant amounts of capital from leading Silicon Valley venture capital firms at high valuations and low-cost debt from banks and venture debt firms, combined with the perception that the on-demand food delivery market was expanding quickly and would be dominated by one or two brands– as Uber had dominated the ridesharing market– drove the company to aggressively invest in its business ahead of having a well-established and scalable business model.”

Increased competition from well-funded competitors drove the startup off course, too, and the epic failure that was Blue Apron’s IPO, which had a “material negative impact on access to financing for startups in the online food delivery business,” was just the cherry on top, according to Beriker’s statements.

Munchery’s vendors, who were not notified or paid following Munchery’s announcement, have provided outspoken criticism to the company and venture capital’s lack of accountability in the weeks following Munchery’s shutdown. Lenore Estrada of Three Babes Bakeshop, among several vendors owed thousands of dollars in unpaid invoices, orchestrated a protest outside of Munchery investor Sherpa Capital’s offices in January. She said she has spoken with Beriker and founding Munchery CEO Conrad Chu in an attempt to pick up the pieces of the failed startup puzzle.

“None of us who are owed money are going to get anything,” Estrada told TechCrunch earlier today. “But the CEO, after fucking it all up, is still getting paid.”

Beriker, indeed, is still earning a salary of $18,750 per month, one-half of his pre-bankruptcy salary, as well as a “success fee based on the net proceeds recovered from the sale of the company’s assets up to a maximum of $250,000,” the filing states.

View the full bankruptcy filing here:

-

Entertainment7 days ago

Entertainment7 days agoThis nova is on the verge of exploding. You could see it any day now.

-

Business7 days ago

Business7 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business6 days ago

Business6 days agoThis camera trades pictures for AI poetry

-

Business5 days ago

Business5 days agoTikTok Shop expands its secondhand luxury fashion offering to the UK

-

Business6 days ago

Business6 days agoBoston Dynamics unveils a new robot, controversy over MKBHD, and layoffs at Tesla

-

Business5 days ago

Business5 days agoMood.camera is an iOS app that feels like using a retro analog camera

-

Entertainment7 days ago

Entertainment7 days agoEarth will look wildly different in millions of years. Take a look.

-

Business4 days ago

Business4 days agoUnitedHealth says Change hackers stole health data on ‘substantial proportion of people in America’