Startups

Compound launches easy way to short cryptocurrencies

Think Ethereum and other crypto coins are overvalued? Now you can make money when their prices fall via Compound, which is launching its money market protocol for shorting cryptocurrencies today. The Coinbase and Andreessen Horowitz-funded startup today opens its simple web interface allowing users to borrow and short Ethereum, 0x’s ZRX, Brave’s BAT, and Augur’s REP token, or lend them through Compound to earn interest.

“If/when Compound scales, this will lead to some really interesting improvements in market structure, namely, fairer prices” Compound CEO Robert Leshner tells me. The startup spent the summer completing a security audit by Trail Of Bits and adding 26 hedge fund partners who will trade with Compound, offering liquidity to independent investors looking to be matched with borrowers or lenders. Next, the startup wants to offer a stablecoin on its protocol, bring in big financial institutions to add even more liquidity, and partner with a wallet provider to make signup faster.

Compound users visit its site through a Web3 browser such as MetaMask or Coinbase Wallet and enter their Ethereum price. They can then view the interest rates for borrowing and shorting or lending and earning interest for each of the supported tokens. Compound’s secret sauce is that those interest rates are set algorithmically based on demand, though eventually it wants a community governance body to oversee this process.

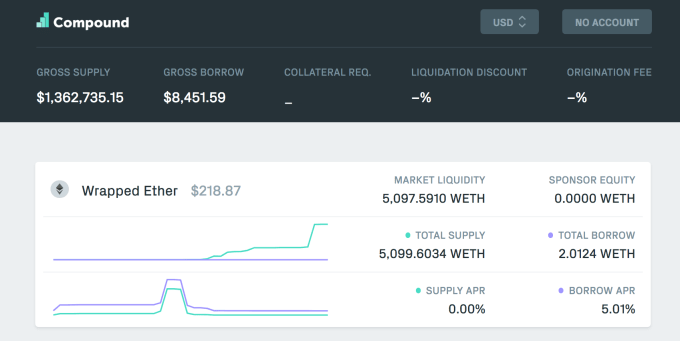

To make sure no one thinks they’re getting scammed, Compound is also releasing a transparency dashboard users can view to check up on all the assets moving through the protocol and see what Compound is earning. It charges 10 percent of what borrowers pay in interest, with the rest going to the lender. That margin is what attracted the $8.2 seed round for Compound that also included Polychain Capital and Bain Capital Ventures.

Compound’s protocol isn’t just useful for crypto haters, or HODLers who want to generate interest instead of just having their coins gathering dust in a wallet. It could also make crypto exchanges like Coinbase or Robinhood less attractive to users because leaving their coins there comes with the opportunity cost of not lending them for profit. Meanwhile, shorts could pop the volatile crypto bubble and push prices to more sensible and stable levels. That’s market health is a critical precursor to big banks and traditional investors diving into crypto.

[Disclosure: The author owns small positions in Bitcoin and Ethereum, but has no financial motive for writing this article, did not make trades in the week prior to this article, and doesn not plan to make trades in the 72 hours following publication.]

-

Business7 days ago

Business7 days agoAPI startup Noname Security nears $500M deal to sell itself to Akamai

-

Entertainment6 days ago

Entertainment6 days agoNASA discovered bacteria that wouldn’t die. Now it’s boosting sunscreen.

-

Business6 days ago

Business6 days agoTesla drops prices, Meta confirms Llama 3 release, and Apple allows emulators in the App Store

-

Business5 days ago

Business5 days agoTechCrunch Mobility: Cruise robotaxis return and Ford’s BlueCruise comes under scrutiny

-

Entertainment5 days ago

Entertainment5 days ago‘The Sympathizer’ review: Park Chan-wook’s Vietnam War spy thriller is TV magic

-

Business4 days ago

Business4 days agoTesla layoffs hit high performers, some departments slashed, sources say

-

Business4 days ago

Business4 days agoMeta to close Threads in Turkey to comply with injunction prohibiting data-sharing with Instagram

-

Entertainment3 days ago

Entertainment3 days agoChatGPT vs. Gemini: Which AI chatbot won our 5-round match?