Business

China startup deals shrink as fundraising for investors plummets

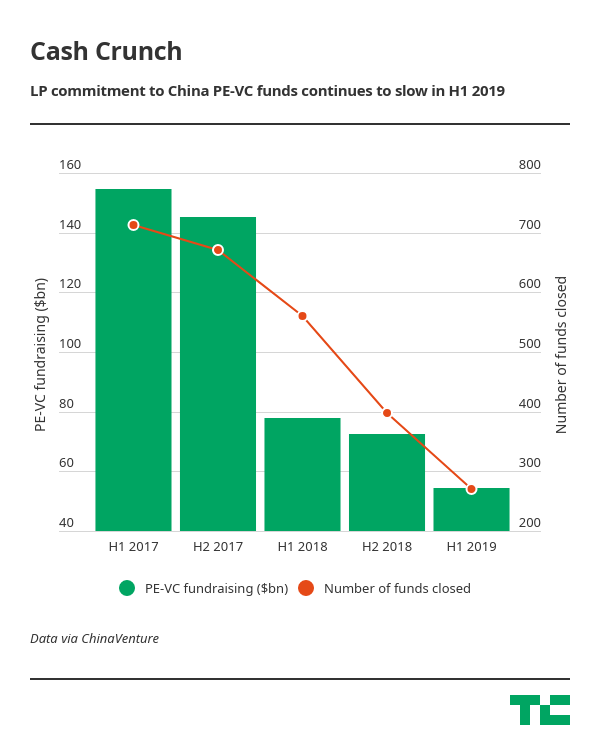

Chinese startups continue to weather tough times as private investors, caught in a cash crunch, are concentrating money into fewer deals.

China’s deal-making activity for startups in the six months ended June halved from a year ago to 1,910, according to data from consulting firm ChinaVenture’s research arm. The amount invested in domestic startups during the first half of 2019 plummeted 54% to $23.2 billion.

The slide in startup investment comes as the money behind the money shrinks amid a cooling economy in China that is exacerbated by a trade war with the U.S. Fundraising for investors was already showing signs of slowdown a year earlier. In the first half of this year, private equity and venture capital firms in China secured 30% less than what they had raised over the same period a year ago, amounting to a total of $54.44 billion; 271 funds managed to raise, down 52%.

That money from limited partners is also flowing to a small rank of investors. Twelve institutions accounted for 57% of all the capital landed by VCs and PEs in the period. Investment coffers that have gotten a big boost include the likes of TPG Capital, Warburg Pincus, DCG Capital, Legend Capital and Source Code Capital.

Healthcare was the most-backed sector during the six months, although proptech startups scored the biggest average deal size. Some of the highest funded companies from the period were artificial intelligence chip maker Horizon Robotics, shared housing upstart Danke and China’s Starbucks challenger, Luckin.

-

Entertainment7 days ago

Entertainment7 days agoThis nova is on the verge of exploding. You could see it any day now.

-

Business6 days ago

Business6 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business6 days ago

Business6 days agoThis camera trades pictures for AI poetry

-

Business5 days ago

Business5 days agoTikTok Shop expands its secondhand luxury fashion offering to the UK

-

Business6 days ago

Business6 days agoBoston Dynamics unveils a new robot, controversy over MKBHD, and layoffs at Tesla

-

Business4 days ago

Business4 days agoMood.camera is an iOS app that feels like using a retro analog camera

-

Entertainment7 days ago

Entertainment7 days agoEarth will look wildly different in millions of years. Take a look.

-

Business4 days ago

Business4 days agoUnitedHealth says Change hackers stole health data on ‘substantial proportion of people in America’