Business

Blade raises $4.3M from Coinbase, SV Angel to reshape cryptocurrency derivatives trading

Exchanges like Coinbase have ballooned in size by taking the mechanics of equity markets and fitting them to cryptocurrency markets, but as the space expands in its scope and craftiness, new exchanges trading asset classes native to cryptocurrency are taking off and attracting the attention of top Silicon Valley VCs, oh, and Coinbase too.

Blade is a new cryptocurrency derivatives exchange launching in three weeks. Prior to starting the company, CEO Jeff Byun and his co-founder Henry Lee founded OrderAhead, a delivery startup platform which was eventually acquired in-part by Square in 2017. The pair’s newest company shares little in common with their previous venture, but they are bringing aboard some of the same investors to support them.

Blade is announcing that they’ve raised $4.3M in seed funding from a host of investors, including Coinbase, SV Angel, A.Capital, Slow Ventures, Justin Kan and Adam D’Angelo.

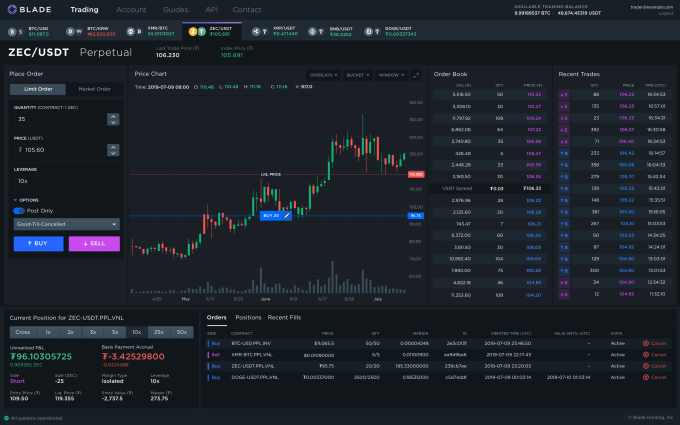

The exchange is tackling perpetual swap contracts.

Perpetuals are a crypto-native trading instrument that Byun says are “arguably the fastest growing segment of cryptocurrency trading.” They allow traders to bet on the future values of cryptocurrencies in relation to another and the instruments have no expiration dates unlike fixed maturity futures. Traders can bet on how the price of Bitcoin can increase relative to USD but they can also make bets relative to other Altcoins like Monero, DogeCoin, Zcash, Ripple and Binance Coin. Here’s what’s on the Blade menu at the moment.

Blade’s noteworthy spins on perpetuals trading — compared to other exchanges — are that most of the contracts will be set up on simplified vanilla contracts, the perpetuals will also be margined/settled in USD Tether and the company is offering higher leverages (up to 150x on BTC-USD and BTC-KRW) on trades.

Blade is raising funds from Silicon Valley’s VCs but US investors won’t be legally able to participate in the exchange. US government agencies have been a bit more stringent in regulating cryptocurrencies so there’s more trading activity taking place on exchanges outside the jurisdiction. Blade itself is an offshore entity with a US subsidiary; its primary market is East Asia.

“It’s kind of a bifurcated market,” CEO Jeff Byun tells TechCrunch. “Either you have exchanges like Coinbase or Gemini or Bitrex that cater to the US market that are highly regulated or the exchanges that cater to the non-US market that are much less regulated, but that’s where most of the volume is.”

While the company is still three weeks away from launch, the founders have bold ambitions.

“In the long-term, we want to be the CME (Chicago Mercantile Exchange) of crypto,” Byun tells me. “Coinbase and Binance are building this foundational structure for crypto, but I think we are too and in a sense that derivatives are at their core about risk transfer, we want to be building the foundational layer for risk transfer in the crypto markets.”

-

Business7 days ago

Business7 days agoConsumer Financial Protection Bureau fines BloomTech for false claims

-

Business5 days ago

Business5 days agoLangdock raises $3M with General Catalyst to help businesses avoid vendor lock-in with LLMs

-

Entertainment5 days ago

Entertainment5 days agoWhat Robert Durst did: Everything to know ahead of ‘The Jinx: Part 2’

-

Entertainment4 days ago

Entertainment4 days agoThis nova is on the verge of exploding. You could see it any day now.

-

Business4 days ago

Business4 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business4 days ago

Business4 days agoThis camera trades pictures for AI poetry

-

Business5 days ago

Business5 days agoCesiumAstro claims former exec spilled trade secrets to upstart competitor AnySignal

-

Business6 days ago

Business6 days agoScreen Skinz raises $1.5 million seed to create custom screen protectors