Appointment scheduling service Calendly has redesigned its browser extension in a bid to improve its schedule management features and make...

Welcome, folks, to Week in Review (WiR), TechCrunch’s regular newsletter covering this week’s noteworthy happenings in tech. TikTok’s fate in the U.S. looks uncertain after President...

It took less than a week for NASA Administrator Bill Nelson’s gaffe to make it to social media. Over an hour into a budget hearing for...

Shopping for a new laptop is a tough task as it is. With the sheer number of options, it’s easier than ever to fall into a...

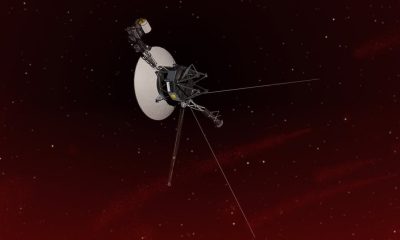

NASA’s Voyager craft have ventured where no other human machines have ever gone — the space between the stars. But that comes with a cost. At...

Quick links: How to watch ‘The Idea of You’ on Prime Video BEST FOR STUDENTS Prime Student 6-month free trial, then $69/year Anne Hathaway is making...