With The Jinx: Part Two coming to Max, you might be scratching your brain trying to recall all the relevant...

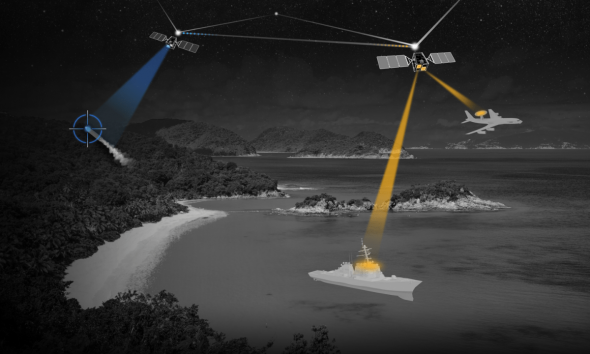

Former senior SpaceX executive Tom Ochinero is teaming up with SpaceX alum-turned-VC Achal Upadhyaya and one of Sequoia’s top finance leaders, Spencer Hemphill, on a new...

How to watch ‘The Sympathizer’ at a glance: BEST FOR CRICKET CUSTOMERS Max (With Ads) Free for Cricket customers on the $60/month unlimited plan (save $9.99/month)...

Tesla management told employees Monday that the recent layoffs — which gutted some departments by 20% and even hit high performers — were largely due to...

ChatGPT vs. Gemini is the AI showdown I’ve been itching to stage – and now I’m finally pitting the most popular chatbots in a head-to-head, nail-biting...

Tesla management told employees Monday that the recent layoffs — which gutted some departments by 20% and even hit high performers — were largely due to...