Finance

What people get wrong about the market’s favorite recession signal

Sara Silverstein: What’s your outlook for the Fed?

David Kelly: I think the Fed will keep on tightening. I mean, the economy’s doing very well. We’ve met all their targets in terms of growth, in terms of unemployment, in terms of inflation. I think they are worried, frankly, about all this fiscal stimulus. We’re at full employment. You don’t normally put this much stimulus into an economy at full employment. It’s kind of like bringing an extra keg to a frat party at 2 a.m. It’s going to make the party louder but it’ll make the hangover worse. So they’ve got to counteract this fiscal stimulus. I think that’s what they’re going to do. So I think another four rate hikes in September, December, March, and June, that’ll bring us up to two and three-quarters to 3% on the federal funds rate. I think and I hope they’ll stop there, because you’re talking about risks. The other risk to the economy is the Fed overtightens the rate. Just as the economy slows down in the second half of next year — and we think it will — if they raise rates too much at that point, that could cause problems.

Silverstein: And what will the yield curve look like a year from now after they raise rates?

Kelly: If they stop at four, I think it’ll be almost exactly flat. In other words, I think the yield on a two-year treasury note will be the same as the yield on a 10-year bond. If they go more than four rate hikes, I think it might get inverted, but — people worry too much about an inverted yield curve. It is a broken barometer. It used to be the yield curve was a very good predictor of what the economy was going to do, because why would you buy a long-term bond with a lower yield than a short-term bond? It’s because you think the Fed’s going to cut rates. Why’s the Fed going to cut rates? Because the economy’s in trouble. But you can’t trust the long end any more.

Silverstein: Why?

Kelly: Well, because central banks have been buying long-term bonds like never before, and they’re basically sitting at the long end of the yield curve, and that’s distorting it. It’s kind of like, I don’t believe in torture, because torture is immoral, but also, a tortured prisoner is going to lie to you. The yield curve is being tortured by central banks, and is going to tell us lies. Now, it doesn’t mean there couldn’t be problems in the future, but we’re going to need a better measure of what’s going on than the yield curve.

Silverstein: And how does an inverted yield curve affect consumers or borrowers?

Kelly: That’s a funny thing. It is a symptom without being a disease. Because, as I said, an inverted yield curve has usually been a problem, or has suggested a problem is coming, because it means the Fed’s worried about something. But if you think about it, American households have got about three dollars in financial, interest-bearing assets for every one dollar they have in debt. And most of those interest-bearing assets are short-term, things like CDs, and most of that data are long-term, things like mortgages, so if you got an inverted yield curve if short rates go up more than long rates, guess what, you’re giving more income to consumers, and you’re not pushing up their expenses. It actually stimulates the economy. And that’s one of the funny things, people worry about it, but it’s harmless as of itself, and if it doesn’t work as a barometer of where the economy is going, there are lots of things to worry about, think about. I wouldn’t worry too much about the yield curve.

-

Entertainment6 days ago

Entertainment6 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Entertainment5 days ago

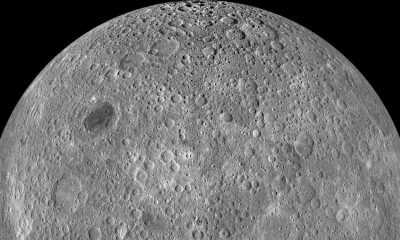

Entertainment5 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

Business6 days ago

Business6 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business5 days ago

Business5 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business4 days ago

Business4 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business7 days ago

Business7 days agoZomato’s quick commerce unit Blinkit eclipses core food business in value, says Goldman Sachs

-

Entertainment7 days ago

Entertainment7 days agoMonsta X’s I.M on making music, gaming, and being called ‘zaddy’