Finance

Turkish lira price on August 16 rallies against dollar after $15 billion Qatar loan

Turkish

President Tayyip Erdogan.

REUTERS/Umit

Bektas/File Photo

The

Turkish lira continued to retreat from its historic low

against the dollar on Thursday after Qatar announced a $15

billion funding package for Turkey’s wobbling economy.

The

dollar is down 2.5% against the lira to 5.8052 at 8.12 a.m.

BST (3.12 a.m. ET) on Thursday morning. It follows a surge over

the last week and a half that saw the dollar climb to over 7 lira

at its worst.

The latest strengthening of Turkey’s currency comes after Qatar

announced a $15 billion funding package for Turkey late on

Wednesday evening.

Tamim bin Hamad Al Thani, the Amir of Qatar, tweeted:

“Today, in the framework of important negotiations with His

Excellency President Erdogan in Ankara, we announced a package of

deposits and investment projects worth $15 billion in this

country, which has a productive, strong and robust economy.”

Turkish President Tayyip Erdogan tweeted: “On behalf of the

Turkish people, I sincerely thank Sheikh Tamim and the Qatari

people for standing by Turkey. There is no doubt that our strong

relations with the friendly and brotherly state of Qatar will

continue to evolve in many areas.”

Turkey’s currency has come under pressure due to rising

diplomatic tensions and cooling trade relations with the US,

Erdogan’s perceived control over the country’s central bank, and

a strong US dollar. Erdogan has accused the US of waging an

economic “war” against the country.

The lira pressure began to ease on Monday when the Turkish

central bank

promised it would take “all necessary measures” to protect the

economy. Turkey’s banking watchdog on Wednesday also

moved to crack down on shorting of the lira.

Hussein Sayed, the chief market strategist at FXTM, said in an

email on Thursday: “Such measures may only provide short-term

relief and policymakers need to address the longer-term

challenges that will face the country.

“With inflation expected to skyrocket in the coming months, a

current account deficit that exceeds $50 billion and more than

$16 billion of debt maturing in 2019, investors fear that the

currency crisis will turn into a debt crisis.

“Even if tensions between the US and Turkey are resolved,

investors still need to see serious fiscal and monetary measures

to restore confidence.”

-

Business6 days ago

Business6 days agoGoogle lays off workers, Tesla cans its Supercharger team and UnitedHealthcare reveals security lapses

-

Entertainment3 days ago

Entertainment3 days agoiPad Pro 2024 now has OLED: 5 reasons this is a big deal

-

Entertainment7 days ago

Entertainment7 days agoLoneliness in kids: Screen time may play a role

-

Business6 days ago

Business6 days agoThe Rabbit r1 shipped half-baked, but that’s kind of the point

-

Entertainment5 days ago

Entertainment5 days agoWhy should we care what celebrities like Taylor Swift and Billie Eilish say about Palestine?

-

Business4 days ago

Business4 days agoLegion’s founder aims to close the gap between what employers and workers need

-

Entertainment4 days ago

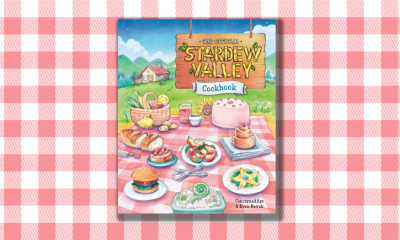

Entertainment4 days ago‘Stardew Valley’ has an official cookbook. Here’s how to make Seafoam Pudding.

-

Entertainment7 days ago

Entertainment7 days agoThe greatest workout playlist demands these soundtracks and scores