Finance

Argentina launches new austerity program, peso slides

-

Argentina reveals new austerity measures aimed at

reducing the country’s huge budget deficit. -

New measures will include an increase in export tariffs

for grains such as soybeans, and a halving of the number of

government agencies. -

The new measures were not well received by investors,

with the peso falling after their announcement.

Argentina late on Monday revealed a series of new austerity

measures aimed at stopping, or at least slowing, the emerging

crisis around its downtrodden economy.

In recent weeks, Argentina’s peso has plunged to record

lows against the US dollar as investors look to move their money

out of the country. Argentina which has an interest rate of 60%,

one of the highest in the world, and a sky-high budget

deficit.

As part of efforts to reduce that budget deficit — a

condition of a large bailout from the International Monetary Fund

(IMF) — President Mauricio Macri launched the new austerity

measures in Argentina’s capital, Buenos Aires, on Monday.

The austerity measures include an increased export tax

on grains, one of the country’s biggest crops, and a cut to the

number of government ministries. Macri said that “about half” of

all ministries will be closed, but did not specify which

ones.

Argentina is one of the biggest producers of corn,

wheat and raw soybeans in the world, and is the single biggest

exporter of soy meal and soy oil, two crucial commodities in the

rearing of livestock.

Monday’s measures come as the IMF, which has extended Argentina

the largest credit line in its history, considers speeding up

bailout payments to the country. Argentine President Mauricio

Macri said last week that he had requested IMF do

so in order to “eliminate any

uncertainty that was created before the worsening of the

international outlook.”

As part of the three-year standby agreement, the government has

received $15 billion and is due to get an additional $3 billion

next month. Nicolas Dujovne, Argentina’s finance

minister, is flying to Washington, D.C., on Tuesday for talks

with IMF chief Christine Lagarde about the possible acceleration

of the rescue package, which is worth a maximum of $50

billion.

Unfortunately for the Argentinian government, the new

austerity plans were not received as hoped in international

markets, and the peso slid on the news.

It has since recovered a little, but still remains almost

25% lower over the last week, as the chart below shows (the most

common pairing of the currency is against the US dollar, which

rises as the peso falls):

Markets Insider

Markets Insider

Paul Donovan, chief economist at UBS Wealth Management

summed up the lukewarm response to the new measures in a morning

email. “Argentina’s government revealed an austerity plan, with

the aim of restoring investor confidence,” he wrote to

clients.

“The Argentine peso weakened on the news, suggesting that

there may be some way to go before confidence is

restored.”

The rating agency Moody’s last week cut its growth forecast for

Argentina, citing the ballooning debt burden and a weakening

peso. It estimates that GDP will contract by 1% next year,

compared with previous expectations for a 3%

expansion.

-

Entertainment7 days ago

Entertainment7 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

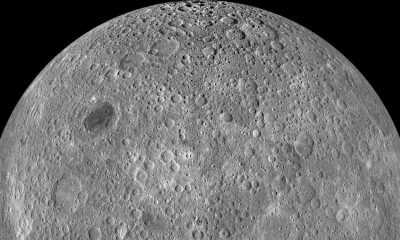

Entertainment6 days ago

Entertainment6 days agoWhat’s on the far side of the moon? Not darkness.

-

Business7 days ago

Business7 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

Business6 days ago

Business6 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business5 days ago

Business5 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business5 days ago

Business5 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business6 days ago

Business6 days agoPhoto-sharing community EyeEm will license users’ photos to train AI if they don’t delete them

-

Entertainment7 days ago

Entertainment7 days ago‘Challengers’ review: You’re not ready for Zendaya’s horny love-triangle drama