Finance

10 things you need to know in markets August 2

Tourists

walk past giant hand structure on the Gold Bridge on Ba Na hill

near Danang City, Vietnam August 1, 2018.

REUTERS/Kham

Good morning! Here’s what you need to know in markets on

Thursday.

1.

Chinese stocks are getting hosed amid the threat of higher US

tariffs on Chinese imports, as well as the potential for further

property market restrictions. China’s Shangai

Composite is down 2.5% at the time of writing (7.17 a.m. BST/2.17

a.m. ET). Elsewhere in Asia, Japan’s Nikkei stock index closed

down 1.07% and the Hong Kong Hang Seng is down 2.5% at the time

of writing.

2.

President Donald Trump could be about to double down on the next

phase of the trade war with China. Senior

administration officials told reporters Wednesday that Trump

asked the US Trade Representative to explore the possibility of

imposing a 25% tariff on $200 billion worth of Chinese imports to

the US. The original proposal proposed hitting the same amount of

goods with a 10% tariff.

3.

Barclays’ second-quarter pretax profits almost trebled compared

with a year ago, the lender said on Thursday, beating analysts’

expectations as it avoided the heavy restructuring and legal

costs that blighted past results. Reuters reports

that Barclays made a pre-tax profit of £1.9 billion for the three

months from April-June, up from £659 million a year ago.

4.

The Federal Reserve announced Wednesday that it decided during a

two-day policy meeting to keep its key interest rate

unchanged. Traders had widely expected this

decision, anticipating that the Fed would raise the benchmark for

borrowing costs two more times this year including next month.

5.

The Bank of England is set to hike interest rates for just the

second time since the financial crisis later on

Thursday. Markets are pricing a more than 90% chance

of a hike but UBS strategist John Wraith says a hike at 12 p.m.

BST (7.00 a.m. ET) today is an “unnecessary risk.”

6.

British engine-maker Rolls-Royce said that its 2018 results would

come in at the upper half of its guidance range after its civil

aerospace and power systems businesses posted a stronger than

expected first-half performance. Reuters reports

that the upgrade to guidance comes despite the company being

under pressure to fix problems with its Trent 1000 engine which

powers the Boeing 787.

7.

Aviva said it was on track to hit its target of 5% growth this

year, despite a fall in first-half profits. The

Financial Times said that the insurer reported operating profits

of £1.44 billion, down 2% on last year.

8.

Following the February stock market correction, tight market

liquidity was largely looked at as a symptom rather than a

cause. A new study from Goldman Sachs throws that

into question, arguing that constrained liquidity conditions

actually helped cause and worsen the sell-off.

9.

Tesla on Wednesday reported second-quarter losses that were

greater than Wall Street’s expectations. Shares

dipped immediately after the release, before rallying back into

the green in after-hours trading.

10.

Global manufacturing is plagued by increasing supply-chain

bottlenecks, cost pressures, and weakening demand from abroad,

leading to a slowdown in production levels and slower hiring

levels. IHS Markit’s Global Manufacturing PMI,

produced in conjunction with JP Morgan, fell to 52.7 last month

after seasonal adjustments, down marginally from 53.0 in June.

-

Entertainment7 days ago

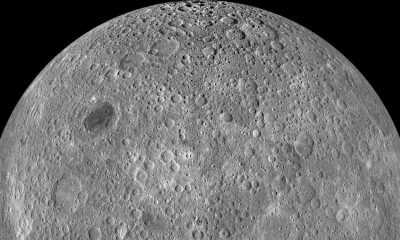

Entertainment7 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business6 days ago

Business6 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Entertainment7 days ago

Entertainment7 days agoHow to watch ‘The Idea of You’: Release date, streaming deals

-

Entertainment6 days ago

Entertainment6 days agoMark Zuckerberg has found a new sense of style. Why?

-

Business5 days ago

Business5 days agoHumanoid robots are learning to fall well

-

Entertainment5 days ago

Entertainment5 days ago2024 summer TV preview: 33 TV shows to watch this summer

-

Business4 days ago

Business4 days agoGoogle Gemini: Everything you need to know about the new generative AI platform