Business

US automakers need to make up their minds already

Consumers in the U.S. have the memory of a goldfish.

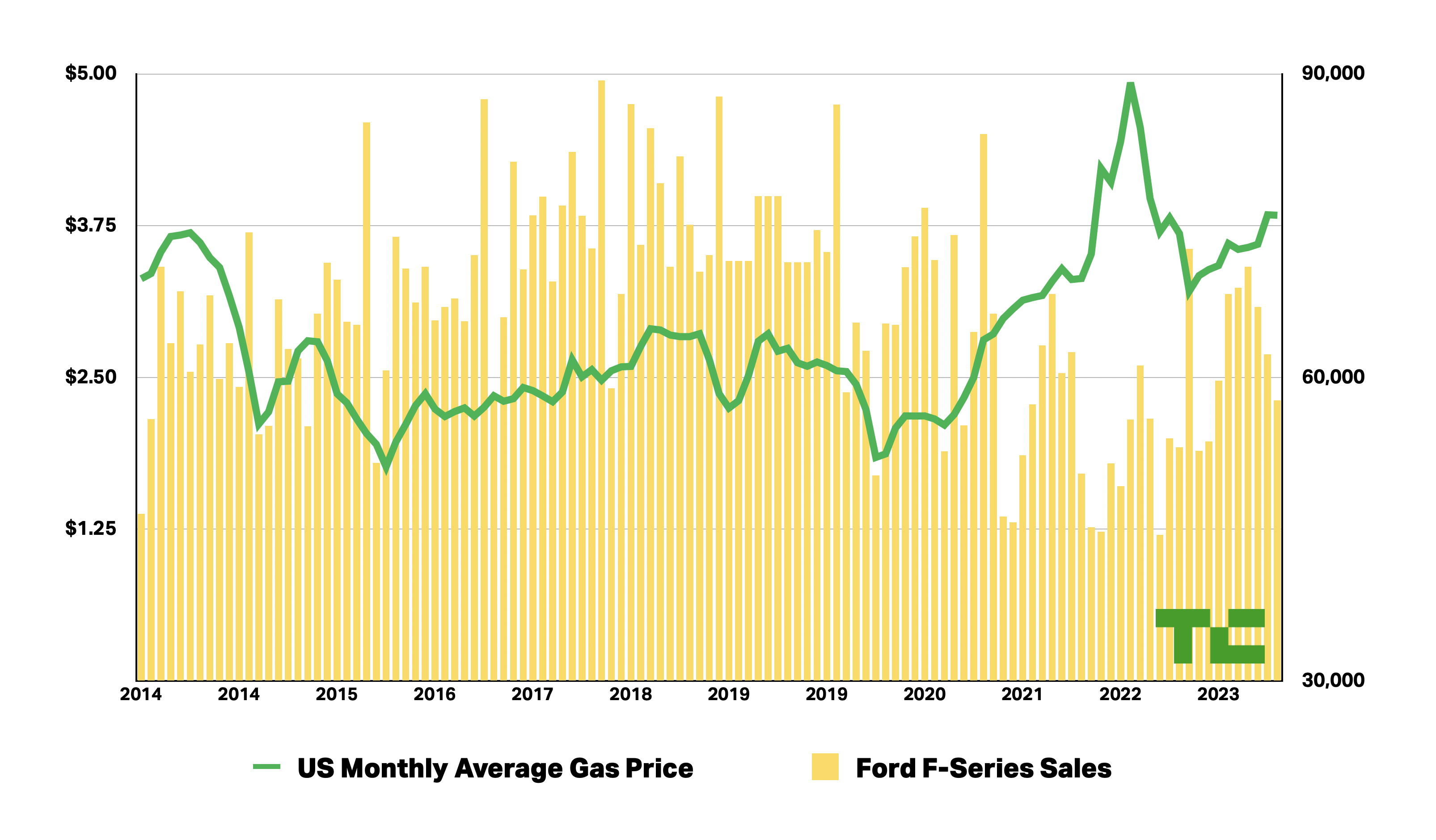

When gas prices are up, they seek out more fuel-efficient transportation. But when they’re down, they rush to buy the biggest truck possible. Just take a look at Ford F-Series sales data from the last decade juxtaposed with average monthly gas prices.

Image Credits: Tim De Chant/TechCrunch+

See? Goldfish.

It turns out U.S. automakers resemble their customer base. A few years ago, they were bullish on electric vehicles. But now, after just a couple years of serious investment, they’re starting to get cold feet.

Ford and GM, in particular, have said that they’re just responding to their customers’ needs. And maybe they are! Some consumers remain wary because EV charging still sucks. Others have been scared off by high prices. (Arguably, these are both self-inflicted wounds: Legacy automakers have refused to consider charging a key part of the ownership experience, and Ford and GM have continually hiked EV prices in a way that’s out of step with the market.)

Such customer responsiveness can be an asset in normal times, allowing businesses to adjust their product lines to ride the ups and downs of the market. Yet in times of transition, when the future is in flux, it can be a awful way to run a business.

Legacy automakers have long said that their profitable model lines would be a strength as the market transitions to electric vehicles. All three businesses have announced that they’d be investing billions in developing EVs and making the batteries that power them, and it would appear that the plan is working out just fine.

Over the last decade, automakers have flocked to crossovers, SUVs and pickup trucks, three segments that are the most profitable. U.S. automakers have gone further than most. Ford even went as far as to stop producing mass market cars, focusing instead on crossovers, SUVs and pickups with the occasional Mustang coupe thrown in for branding purposes.

How’s it been working out? Pretty well, actually. Ford reported $1.2 billion in profit for Q3, not bad given headwinds induced by the UAW strike. GM did better, raking in $3.1 billion in the same quarter. Stellantis doesn’t generally announce its quarterly earnings until November, but it had a gangbuster first half of the year, posting $12.1 billion in profit.

So why have Ford and GM decided to pump the brakes on their EV plans?

-

Business7 days ago

Business7 days agoCheckfirst raises $1.5M pre-seed, applying AI to remote inspections and audits

-

Business5 days ago

Business5 days agoAI chip startup DEEPX secures $80M Series C at a $529M valuation

-

Entertainment4 days ago

Entertainment4 days agoJinkx Monsoon promises ‘the queerest season of ‘Doctor Who’ you’ve ever seen!’

-

Business4 days ago

Business4 days agoStrictlyVC London welcomes Phoenix Court and WEX

-

Business5 days ago

Business5 days agoRetell AI lets businesses build ‘voice agents’ to answer phone calls

-

Entertainment4 days ago

Entertainment4 days agoHow to watch every ‘Law and Order’ online in 2024

-

Entertainment5 days ago

Entertainment5 days ago'House of the Dragon' recap: Every death, ranked by gruesomeness

-

Entertainment6 days ago

Entertainment6 days ago8 reasons ‘Evil’ is the greatest show you’re not watching