Business

Lordstown Motors’ ousted CEO settles with SEC for misleading investors

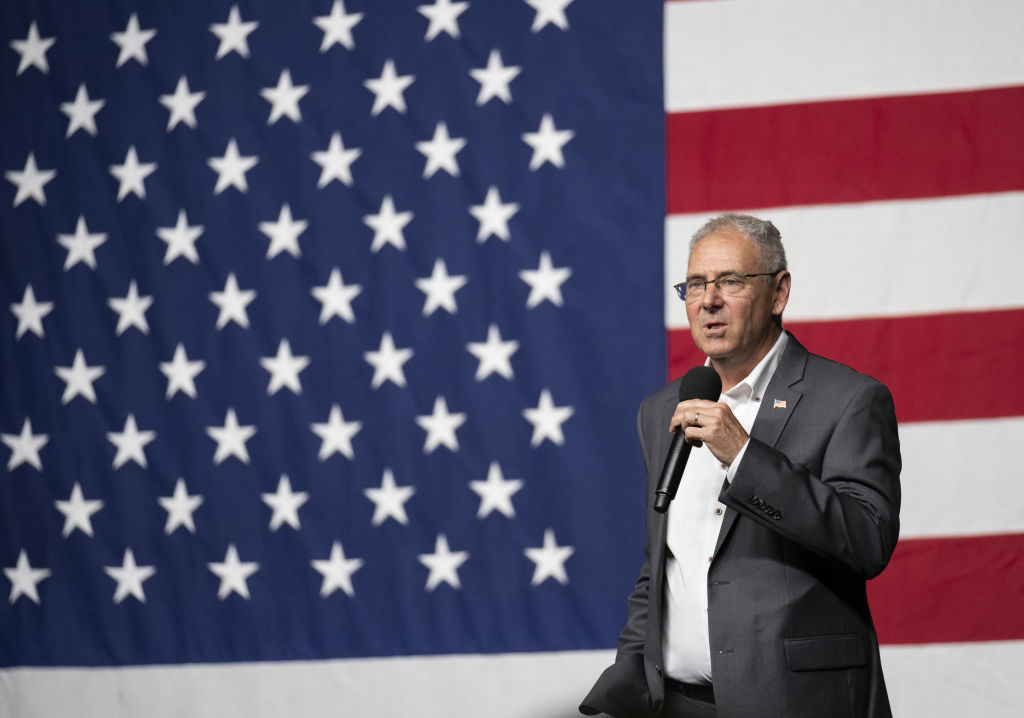

Steve Burns, the ousted founder, chairman and CEO of bankrupt EV startup Lordstown Motors, has settled with the U.S. Securities and Exchange Commission over misleading investors about demand for the company’s flagship all-electric Endurance pickup truck.

Burns was ordered to pay a civil fine of $175,000 and cannot serve as an officer or director of a public company for two years, according to the agreement filed with the U.S. District Court for the District of Columbia. Without admitting or denying the SEC’s allegations, Burns consented to a permanent injunction, the fine and other stipulations in the agreement, according to the SEC.

The SEC charged Lordstown Motors in February 2024 with misleading investors about the sales prospects of its Endurance electric pickup truck. The company agreed to pay $25.5 million. At the time, it wasn’t clear that the SEC was also going after Burns.

Lordstown Motors was founded in April 2019 as an offshoot of Burns’ other company, Workhorse Group. The company went public the following year via a merger with a special purpose acquisition company DiamondPeak Holdings Corp., with a market value of $1.6 billion. During and after the merger, Lordstown received $780 million from investors, according to the SEC.

The company was among a batch of EV startups that went public via mergers with blank-check businesses in 2020 and enjoyed skyrocketing share prices that soon fell back to earth as they grappled with the challenge of producing and selling electric vehicles. Lordstown Motors attracted the attention and investment of GM and even acquired the 6.2 million-square-foot assembly plant in Lordstown, Ohio from the automaker.

By June 2020, Lordstown was riding high after revealing its Endurance electric pickup in a splashy and political-leaning ceremony that featured former Vice President Mike Pence, who spoke for 25 minutes about former President Trump’s policies on jobs and manufacturing, China and the COVID-19 response.

Burns told the crowd that it had received 20,000 pre-orders, a number that would have locked in the entire first year of production if every customer who pre-ordered the truck followed through and bought the vehicle. Burns later said the company had received 100,000 nonbinding pre-orders from commercial fleet customers.

Short seller research firm Hindenburg Research disputed those claims and ultimately Burns, along with other executives, would resign by June 2021.

The SEC later investigated the claims and said Lordstown Motors and Burns made misleading statements about the business because most of the pre-orders were not submitted by commercial fleet customers, but rather by businesses that did not operate fleets or intend to buy the truck for their own use. This, the SEC says, created an unrealistic and inaccurate depiction of demand for the truck from commercial fleet customers.

Lordstown continued on a rocky road even after Burns left, and eventually filed for Chapter 11 bankruptcy protection. In March, Lordstown Motors emerged from bankruptcy with a new name and a nearly singular focus: continuing its lawsuit against iPhone-maker Foxconn for allegedly “destroying the business of an American startup.” The company is now known as Nu Ride Inc.

Burns has also moved on since his resignation. In January, Burns launched a new company called LandX Motors.

-

Business7 days ago

Business7 days agoIndia’s election overshadowed by the rise of online misinformation

-

Business7 days ago

Business7 days agoThis camera trades pictures for AI poetry

-

Business6 days ago

Business6 days agoTikTok Shop expands its secondhand luxury fashion offering to the UK

-

Business7 days ago

Business7 days agoBoston Dynamics unveils a new robot, controversy over MKBHD, and layoffs at Tesla

-

Business5 days ago

Business5 days agoMood.camera is an iOS app that feels like using a retro analog camera

-

Business5 days ago

Business5 days agoUnitedHealth says Change hackers stole health data on ‘substantial proportion of people in America’

-

Business3 days ago

Business3 days agoTesla’s new growth plan is centered around mysterious cheaper models

-

Entertainment5 days ago

Entertainment5 days agoFurious Watcher fans are blasting it as ‘greedy’ over paid subscription service