Business

Finofo secures funding to challenge traditional forex with automated solution

Exchange rate volatility has long been a major headache for cross-border businesses. Historically, businesses have sought protection by purchasing foreign exchange (FX) insurance or options, but most of these financial products operate like giant “black boxes”, Finofo‘s co-founder and CFO Charles Maranda told TechCrunch in an interview.

Maranda’s company aims to provide more transparency and control to users in the opaque FX world, an enormous industry that recorded $156 trillion in global cross-border payment flows last year.

“The basic idea is we have to democratize this process for businesses. Right now, if you are a business, either your CFO knows about [FX], which is quite rare, especially for SMBs, or you hire a non-bank FX broker who’s just going to recommend this and that contract and ask you to sign without really understanding your business,” suggested Maranda, who previously worked as a financial engineer at the National Bank of Canada.

With the flood of money and talent pouring into crypto, “it seems to us that for quite some time, the intellectual capacity of the world stopped caring about this existing financial system and instead tried to build a brand new one,” he added. “It’s forgetting that there’s still a lot to build for this existing system, especially for businesses.”

Maranda co-founded the startup with two friends — Prateek Sodhi, a veteran of the Canadian FX sector and Malav Shah, a former engineer at Pinterest and Facebook.

Left to right: Malav Shah, CTO, and Prateek Sodhi, CEO / Image: Finofo

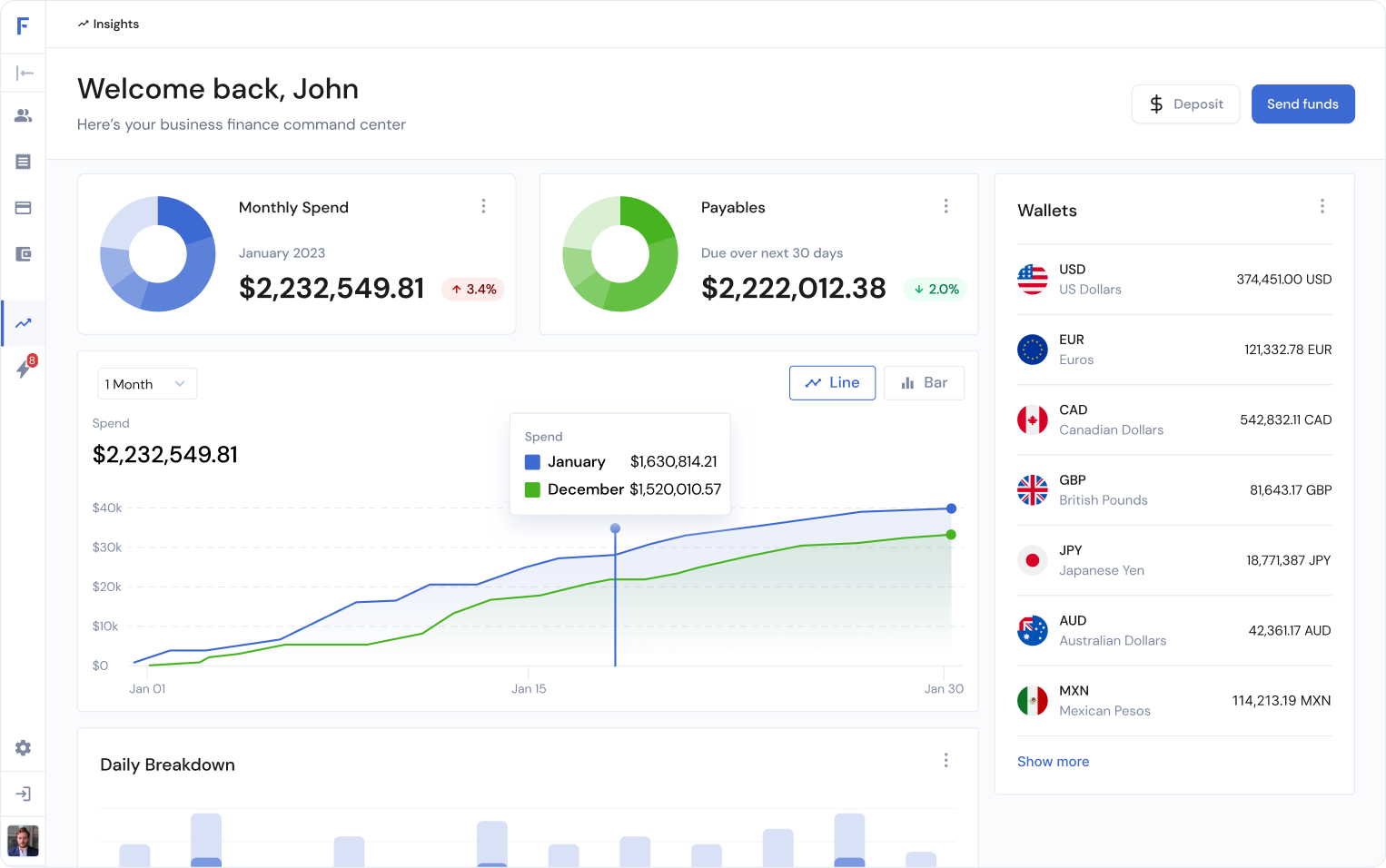

Finofo is unveiling today its free-to-use platform for businesses to get multi-currency accounts to send and receive money globally, convert currencies as well as automate accounts payables.

“We don’t put any barrier through a SaaS fee so businesses can start using our product right away,” said the founder.

For sure, the FX business comes with a mature revenue model already. Finofo monetizes like banks and non-bank forex brokers through interchange spreads — the difference between the buy and sell prices of a currency pair — and payment fees. Even though Finofo is “significantly cheaper than banks” according to Maranda, it’s still a potentially lucrative business.

At a 0.5% spread, for example, which is considered quite low, a broker could be making $50,000 annually from just one small-and-medium enterprise customer, which could easily exchange $10 million a year for its cross-border business.

The next step on Finofo’s product roadmap is to apply its proprietary algorithm to analyze customers’ financial data and make recommendations for financial planning. It takes their accounting data, including invoices and budget spreadsheets, upon which the engine can calculate the optimal time and type of FX contracts for currency conversion.

Finofo’s product screenshot / Image: Finofo

The goal of the financial planning product, said Maranda, is to help businesses understand the risk from currency fluctuation and manage it effectively. “This stands in stark contrast to traditional financial institutions that rely on a one-size-fits-all approach and aggressive sales tactics.”

Eventually, Finofo wants to become some sort of a “super app” for business financial operations where they can plan, strategize, and execute all decisions on one platform.

Currently, financial planning processes are scattered across an array of platforms and done manually, the founder observed. Take a company that needs to send payments to a supplier in China in USD for example. It first needs to get hold of an invoice, which might be a PDF or a slip along with the shipping. Then, someone within the company has to manually enter the invoice information into the accounting system and the banking platform to be approved by a manager high up. When the payment finally gets greenlighted, decisions still need to be made around currency conversion: Do we use an existing financial contract? Do we already have USD to pay for that?

“There’s a lot of back and forth within the team,” said Maranda. “So we trying to regroup that and add the planning component to become a super app.”

Finofo has raised some initial capital to work on its vision. Along with its product launch, it announced today the completion of a $1.25 million pre-seed round led by Motivate Venture Capital, with participation from SaaS Venture Capital, Sweet Spot Capital and Desjardins, a major Canadian financial institution.

Left to right: Charles Maranda, CFO, and Prateek Sodhi, CEO / Image: Finofo

Established by first-time founders, Finofo managed to get a16z’s attention by cold messaging a fintech partner at the firm on Twitter. The investor eventually passed on the deal as Finofo was “too early-stage,” but it played a crucial role in facilitating introductions to other investors who ended up joining the round.

Run by a team of seven people most of whom are based in Calgary, Finofo is targeting the Canadian market first through a local banking partner; it’s also registered with the Financial Transactions and Reports Analysis Centre of Canada, or FINTRAC, the country’s financial intelligence unit.

Winning user trust for a financial planning app that also handles transactions is undoubtedly a challenging task. To that end, Finofo is allocating plenty of resources to customer service and education by “always being available and finding a solution on the spot,” Maranda said. “You have to do the thing that doesn’t scale first.”

-

Business6 days ago

Business6 days agoTesla’s new growth plan is centered around mysterious cheaper models

-

Business5 days ago

Business5 days agoXaira, an AI drug discovery startup, launches with a massive $1B, says it’s ‘ready’ to start developing drugs

-

Business6 days ago

Business6 days agoUK probes Amazon and Microsoft over AI partnerships with Mistral, Anthropic, and Inflection

-

Entertainment4 days ago

Entertainment4 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Business5 days ago

Business5 days agoPetlibro’s new smart refrigerated wet food feeder is what your cat deserves

-

Business3 days ago

Business3 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Entertainment3 days ago

Entertainment3 days agoWhat’s on the far side of the moon? Not darkness.

-

Business4 days ago

Business4 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal