Business

Daily Crunch: Fairly stagnant since April launch, Coinbase NFT sales volume is under $700K

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PT, subscribe here.

Friday, May 6, is here. The only thing important about that is the “Friday” part – and we are eager and curious to see what this weekend has in store for us, because this week had many of our colleagues using expletives in their reporting, case in point this report by Natasha and Amanda describing all of the tech layoffs we’ve seen this week.

Meanwhile, in the TechCrunch Slack today, Amanda, after some pushback with minimum context, asked: “Ron, are you implying that Britney Spears didn’t single-handedly create more American jobs?” We will have more national job market analyses coming soon. – Christine and Haje

The TechCrunch Top 3

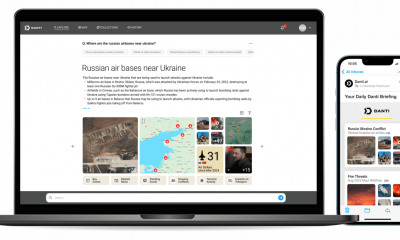

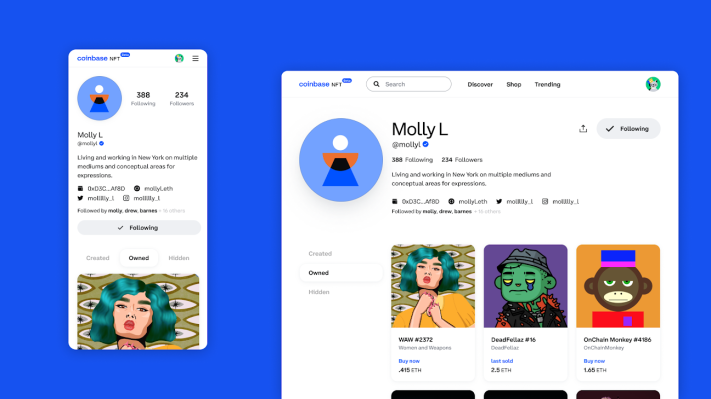

- Coinbase NFT is kind of a NOT: The Coinbase NFT marketplace opened to the public this week, and unlike the line to get into an Apple store on the first day a new iPhone comes out, not as many users are flocking to the service as the company may have expected. Maybe we’re seeing some NFT fatigue. You can judge for yourself as Jacquelyn reports some expert takes on what might be the issue — and whether there’s anything that can solve it.

- We’ve got a ticket to ride, but we may have missed the bike: It looks like Peloton is turning its red knob to the left in order to get the company back on track, Brian reports. In a new report from The Wall Street Journal, the at-home bicycle company that came in handy when we couldn’t go to the gym in 2020 began having some struggles, but is trying to course-correct by possibly selling a 20% stake.

- Missing a piece of the puzzle: When you read something that says, “Simone Giertz, YouTube’s one-time Queen of Shitty Robots, didn’t renounce her crown so much as outgrow it,” you continue. What follows is a delightful discussion that Brian had with Giertz on how her Yetch (you have to read it to know what this is) product collection came to be. The title gives away what one of those products is.

Startups and VC

In what has to be one of our favorite articles on TechCrunch in recent memories, Brian joins Tony Fadell – the man behind the iPod, iPhone and Nest Thermostat – in his garage to see what prototypes and curiosities the longtime product maestro has kicking around. It’s a deeply fascinating tour of the products that could have been and a must-read for any gadget aficionados out there.

We also loved this piece from Carly discussing whether you should delete your period-tracking apps if Roe v. Wade turns out to be a thing of the past, pointing out that many of the app developers are already sharing details with third parties. “It’s unlikely the sensitive data you share with your period-tracking app is going to end up in the hands of those seeking to outlaw abortion,” she writes. “That’s not to say these tools don’t have extensive privacy problems.”

A smattering of tenuous musical puns and great stories:

- Runaway chain, never coming back: The NFT ecosystem continues to chug along, but the vast majority of the volume is still moving through the centralized halls of NFT marketplace OpenSea, leaving crypto VCs eager to find new channels. Haun Ventures leads a $50 million bet on Zora Labs.

- Old MacDonald had a farm, and it’s about time it was kinder to the planet: Tomorrow Farms is fueling a sustainable food train with ingredients to turn the pantry and refrigerator staples we know now into foods that are better for us and kinder to animals and the planet.

- That’s when I fell for … the leader of the tax: MainStreet, a startup that helps other startups uncover tax credits that was valued at $500 million last year, has laid off about 30% of its staff.

- Want you back — want you back for good: Metals and fossil fuels behemoth Glencore is pumping $200 million into battery recycler Li-Cycle as part of a larger, symbiotic supply deal inked by the two firms.

- Don’t call it a comeback; it’s already dawn: Meanwhile, on our subscription site TC+, Alex and Anna conclude that the venture slowdown isn’t coming – it’s already here.

6 places where investors look for problems when you’re fundraising

Image Credits: Andrey Popov (opens in a new window) / Getty Images

According to Bill Petty, a partner with Tercera, these are the six questions investors are most likely to ask while conducting due diligence:

- How is your historical business performance?

- How are you thinking about and planning for growth?

- What is the ownership breakdown?

- Who are your key clients and what is the nature of the work you are completing for them?

- How are you managing the business? What is your attrition, utilization, bill rates, etc.?

- Are there any outstanding risks?

If you can’t answer these off the top of your head, you’re probably not ready to fundraise. Investors have higher expectations than the friends and family who may have helped you get this far.

“It’s the difference between inviting a friend over for dinner and preparing for an open house,” says Petty.

“With a friend, you might tidy up and shove a few things in the closet. If you have buyers coming to look around, they’re going to open that closet.”

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

Since it’s about to be the weekend, let’s kick it off with some drive time: China electric vehicle company Nio is pulling into a Singapore stock market parking space. The company was said to be seeking a secondary listing of its Class A ordinary shares to match one in Hong Kong as the company awaits news on whether its shares will be delisted from the New York Stock Exchange. Meanwhile, Lucid, the maker of the luxury Air sedan, said demand is so good that it will be raising prices on its line of vehicles.

Regulators, mount up: The U.K. is cracking down on what it perceives as Big Tech’s unfair advantage, and Natasha has read all the long documents about some new regulations so you don’t have to. The tl;dr — the government is laying down some rules for Big Tech companies that it says will be necessary to boost competition and let consumers more easily and safely do things like swap between Android and iOS, switch social media accounts without losing data (ouch!) and have more control over who has access to their data.

Meanwhile:

- Can’t stop (won’t stop) did stop the beat: Spotify Stations, the streaming service’s lightweight listening app offering easy access to curated playlists, is shutting down on May 16.

- Causing a commotion: And in case you missed it yesterday, to help fend off the TikTok threat, Meta announced this week it will now dole out additional bonuses to Reels creators who publish original content on Facebook.

-

Entertainment6 days ago

Entertainment6 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Entertainment5 days ago

Entertainment5 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

Business6 days ago

Business6 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business5 days ago

Business5 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business4 days ago

Business4 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Business7 days ago

Business7 days agoZomato’s quick commerce unit Blinkit eclipses core food business in value, says Goldman Sachs

-

Entertainment7 days ago

Entertainment7 days agoMonsta X’s I.M on making music, gaming, and being called ‘zaddy’