Business

An Open Letter to Rishi Sunak – Coronavirus Job Retention Scheme and the Self-Employed

This article has been published on behalf of self-employed students across the United Kingdom whom have been left forgotten as a result of Rishi Sunak’s announcement today of the Coronavirus Job Retention Scheme.

An open letter to Rishi Sunak

Dear Rishi Sunak,

Today, the world heard the unprecedented steps you have taken to help individuals and businesses during the COVID-19 pandemic.

At first I was proud, overwhelmed and grew faith in the British government. However, when digging deeper into the “widespread” support which you announced would help reach as many people as possible, it became clear that in-fact, you are actively isolating a large group of hard-working citizens; the self-employed and students.

What makes this announcement worse is, due to the very specific criteria required for support receipt, individuals taking on the greater challenge of studying full-time and being self-employed, are technically entitled to nothing.

Here are a few reasons why:

- A full time student is not entitled to Universal Credit, even whilst self-employed

- Full time students cannot claim the majority of benefits

- Self-employed individuals cannot benefit from the Job Retention PAYE Scheme

- Self-employed individuals may have less or no chance of applying for the Business Interruption Loan – Specific criteria has not been announced and the likelihood of loaning large sums to a sole-trader with limited assets is slim. Credit scores may also pose an issue.

- Self-employed are not entitled to Statutory Sick Pay (SSP)

- Many self-employed students have no, low or poor credit ratings and therefore may not be entitled to loans. Also, an additional loan onto of existing student loans does not make for sensible financial management.

- Full time students renting who do not receive benefits are not entitled to housing benefit and therefore cannot benefit from any announced rental schemes.

- Full time students cannot rely solely on their student loans. Latest disbursements may not be due for months, and received disbursements may have already been exhausted on accommodation costs, course fees or other expenses.

- Differed Self-assessment tax etc does not immediately support self-employed individuals and have little effect if their earnings do not exceed a specific amount.

Today’s announcement is highly unfortunate for this group of individuals. Self-employed citizens, as a whole, have been let down by today’s announcement. Individual that are self-employed without being a student at the same time, can at least receive the bare bones option of £94.25 per week. On the other hand, full-time students whom are also working as self-employed to make ends meet have been offered £0.

One can only hope a further announcement is made. This is a group of inspiring individuals, not only working hard to build businesses of the future, but also simultaneously working hard to advance their skills.

Yours underwhelmingly,

The Self-Employed Full Time Student

-

Entertainment7 days ago

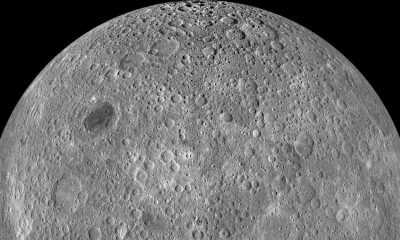

Entertainment7 days agoWhat’s on the far side of the moon? Not darkness.

-

Business6 days ago

Business6 days agoTikTok faces a ban in the US, Tesla profits drop and healthcare data leaks

-

Business6 days ago

Business6 days agoLondon’s first defense tech hackathon brings Ukraine war closer to the city’s startups

-

Entertainment7 days ago

Entertainment7 days agoHow to watch ‘The Idea of You’: Release date, streaming deals

-

Entertainment6 days ago

Entertainment6 days agoMark Zuckerberg has found a new sense of style. Why?

-

Business5 days ago

Business5 days agoHumanoid robots are learning to fall well

-

Entertainment5 days ago

Entertainment5 days ago2024 summer TV preview: 33 TV shows to watch this summer

-

Business4 days ago

Business4 days agoGoogle Gemini: Everything you need to know about the new generative AI platform