Finance

Turkey currency dives to fresh low after Trump tweets new tariff rate

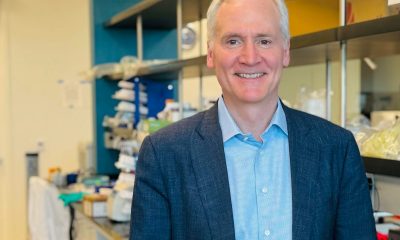

President

Donald Trump, accompanied by Turkish President Recep Tayyip

Erdogan, speaks in the Roosevelt Room of the White House in

Washington Tuesday, May 16, 2017.

Evan

Vucci/AP

-

The Turkish lira fell as much as 17% versus the dollar

Friday. -

Trump said he would double the steel and aluminum

tariff rate for Turkey. -

Washington recently imposed sanctions on Ankara over

detained Americans. -

President Recep Tayyip Erdogan called on citizens to

convert other currencies and gold into lira. -

Watch

the lira trade in real time here.

Turkey’s

currency plunged to fresh all-time lows against the dollar

Friday after President Donald Trump announced in a tweet that he

would double tariffs on aluminum to 20% and on steel to

50%.

“I have just authorized a doubling of Tariffs on Steel and

Aluminum with respect to Turkey as their currency, the Turkish

Lira, slides rapidly downward against our very strong Dollar!”

the president wrote in a tweet. “Our relations with Turkey are

not good at this time!”

The lira dropped as much as 17% against the dollar, its steepest

daily drop in nearly two decades. It has been one of the

worst-performing currencies this year but a deepening rift

between Ankara and Washington has accelerated the selloff.

A Turkish delegation returned from a meeting with Trump

administration officials in Washington on Thursday with no

apparent progress on a conflict over an American pastor who has

been detained in Turkey for nearly two years.

Earlier this month, the Trump administration announced sanctions

against Turkey for failing to release Andrew Brunson, an

evangelical pastor who was arrested in 2016 for allegedly aiding

a failed military coup, claims the pastor denies. The sanctions

target Turkey’s minister of justice and minister of interior,

whom the White House said played leading roles in the arrest and

detention of 50-year-old Brunson.

“It is astonishing that no matter how punished

the

Lira

looks, traders are

showing absolutely no indication that they are finished with

pricing in ‘bad news’ into the market,” Jameel Ahmad, head

of currency strategy and market research at FXTM, said.

During a speech in the Black Seas city of Rize overnight,

President Recep Tayyip Erdogan called on citizens to exchange

hard currencies and gold for the lira. He said the country was

facing an “economic war” and blamed the selloff on credit ratings

agencies and a shadowy “interest rate lobby,” according to

Reuters.

Erdogan is a self-proclaimed “enemy of interest rates” and has

pushed for unorthodox policies like cutting borrowing costs in

the face of accelerating inflation. He had indicated plans

to wield more influence over the country’s central bank in the

runup to his June reelection.

Concerns about the lira seem to already be spreading to other

currencies, analysts say, including the pound and the euro.

“The issue that global investors now need to take into

consideration is that the recipe for a currency crisis in Turkey

is now presenting a risk of a contagion knock-on effect across

other markets,” Ahmad said.

Markets Insider

Markets Insider

-

Business7 days ago

Business7 days agoTesla’s new growth plan is centered around mysterious cheaper models

-

Business6 days ago

Business6 days agoXaira, an AI drug discovery startup, launches with a massive $1B, says it’s ‘ready’ to start developing drugs

-

Business6 days ago

Business6 days agoUK probes Amazon and Microsoft over AI partnerships with Mistral, Anthropic, and Inflection

-

Entertainment4 days ago

Entertainment4 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Business5 days ago

Business5 days agoPetlibro’s new smart refrigerated wet food feeder is what your cat deserves

-

Business4 days ago

Business4 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Entertainment3 days ago

Entertainment3 days agoWhat’s on the far side of the moon? Not darkness.

-

Business4 days ago

Business4 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal