Finance

Stock market seeing shift for first time since financial crisis, 3 recommendations

Reuters / Brendan McDermid

Reuters / Brendan McDermid

-

Value stocks have gotten crushed by their more

growth-driven peers over the course of the nine-year bull

market, but the tide appears to be turning in their

favor. -

Investors looking to play the recent value rebound

would be well served to seek out the three industries that

carry the heaviest weightings in the Russell 1000 Value

index.

Don’t look now, but a much-maligned area of the stock market appears to be mounting

quite the comeback.

We’re referring to so-called value stocks, or equities

characterized by their bargain pricing, relative to the rest of

the market. They’ve beaten their growth-stock brethren by 4% over

the past three days, the biggest outperformance since May 2009

for a period of that length, according to data compiled by

Business Insider.

Put simply, value is having a resurgence not seen since the

aftermath of the financial crisis.

Joe

Joe

Ciolli / Business Insider, data from Bloomberg

To best understand why this reversal is such a big deal, consider

that value stocks have lost a cumulative 40% relative to their

expensive peers worldwide since 2009, and have trailed the

broader market by 17% over the period, according to Bernstein

data.

The reason why is straightforward: As stocks have climbed higher

in seemingly unstoppable fashion, there’s been no reason to seek

bargains.

Proven winners — most notably in the mega-cap tech space —

have continued to dominate. And as traditional measures of

valuation have gotten stretched, investors have shrugged and

stayed the course, citing robust

profit growth

and easy

lending conditions. That’s all come at the expense of the value

trade.

So what does it mean if the value resurgence is here to

stay? For one, it throws a bit of water on the idea that the

market is in a late-cycle environment, since such periods have

historically seen growth stock outperformance. I

t

also throws a bone to value investors, who have struggled to keep

pace with their more growth-driven peers.

With all of that established, the question becomes what

you, the average investor, can do to benefit from a value

rebound. The key lies within the areas that occupy the heaviest

weightings in the largely downtrodden Russell 1000 Value

index: financials, healthcare, and

energy.

A quick check from the past week shows these groups have,

in fact, been leading the market as long-standing outperformers

like mega-cap tech falter. It appears, for the time being at

least, that as historically stretched tech stocks lose their luster, traders are

content to rotate into unloved areas, rather than completely exit

the stock market.

It also doesn’t hurt that the biggest financial firms in

the US are coming off a stellar earnings season, led by strong

results from JPMorgan. Meanwhile, healthcare companies have

enjoyed the highest percentage of positive earnings surprises,

according to Goldman Sachs data. And energy, ever-beholden to the

price of oil, has arguably the biggest upside, should the

resource maintain the steady ascent its seen over

the last 12 months.

In the end, an open-minded investor could do a lot worse

than exploring the value stock universe for bargain-basement

opportunities, especially amid the resurgence that appears to be

underway.

-

Business6 days ago

Business6 days agoTesla’s new growth plan is centered around mysterious cheaper models

-

Business5 days ago

Business5 days agoXaira, an AI drug discovery startup, launches with a massive $1B, says it’s ‘ready’ to start developing drugs

-

Business6 days ago

Business6 days agoUK probes Amazon and Microsoft over AI partnerships with Mistral, Anthropic, and Inflection

-

Entertainment4 days ago

Entertainment4 days agoSummer Movie Preview: From ‘Alien’ and ‘Furiosa’ to ‘Deadpool and Wolverine’

-

Business5 days ago

Business5 days agoPetlibro’s new smart refrigerated wet food feeder is what your cat deserves

-

Business3 days ago

Business3 days agoHow Rubrik’s IPO paid off big for Greylock VC Asheem Chandna

-

Business4 days ago

Business4 days agoThoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

-

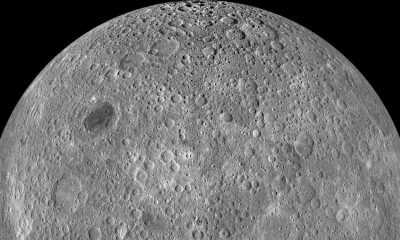

Entertainment3 days ago

Entertainment3 days agoWhat’s on the far side of the moon? Not darkness.